2012 Sales Tax Reporting Form - City Of Whittier

ADVERTISEMENT

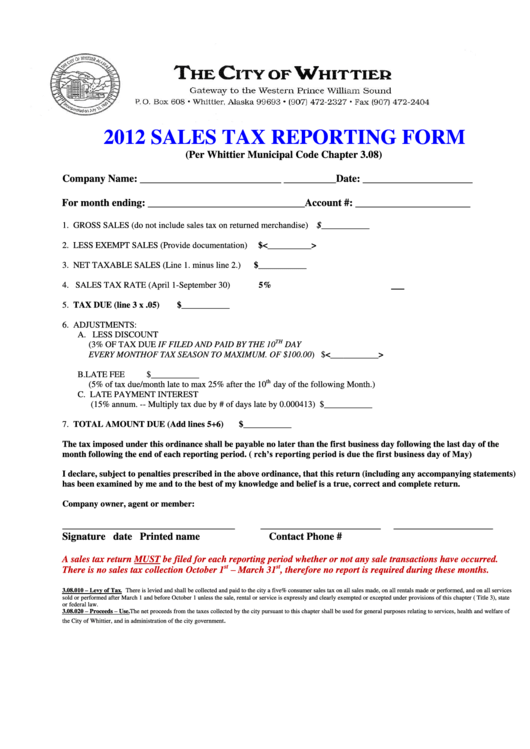

2012 SALES TAX REPORTING FORM

(Per Whittier Municipal Code Chapter 3.08)

Company Name: ___________________________ __________Date: _____________________

For month ending: ______________________________Account #: ______________________

1. GROSS SALES (do not include sales tax on returned merchandise)

$___________

2. LESS EXEMPT SALES (Provide documentation)

$<__________>

3. NET TAXABLE SALES (Line 1. minus line 2.)

$___________

4. SALES TAX RATE (April 1-September 30)

5%

5. TAX DUE (line 3 x .05)

$___________

6. ADJUSTMENTS:

A. LESS DISCOUNT

TH

(3% OF TAX DUE IF FILED AND PAID BY THE 10

DAY

EVERY MONTH OF TAX SEASON TO MAXIMUM. OF $100.00)

$<___________>

B. LATE FEE

$___________

th

(5% of tax due/month late to max 25% after the 10

day of the following Month.)

C. LATE PAYMENT INTEREST

(15% annum. -- Multiply tax due by # of days late by 0.000413)

$___________

7. TOTAL AMOUNT DUE (Add lines 5+6)

$___________

The tax imposed under this ordinance shall be payable no later than the first business day following the last day of the

month following the end of each reporting period. (i.e. March’s reporting period is due the first business day of May)

I declare, subject to penalties prescribed in the above ordinance, that this return (including any accompanying statements)

has been examined by me and to the best of my knowledge and belief is a true, correct and complete return.

Company owner, agent or member:

_________________________________

_______________________

___________________

Signature

date

Printed name

Contact Phone #

A sales tax return MUST be filed for each reporting period whether or not any sale transactions have occurred.

st

– March 31

st

There is no sales tax collection October 1

, therefore no report is required during these months.

3.08.010 – Levy of Tax. There is levied and shall be collected and paid to the city a five% consumer sales tax on all sales made, on all rentals made or performed, and on all services

sold or performed after March 1 and before October 1 unless the sale, rental or service is expressly and clearly exempted or excepted under provisions of this chapter ( Title 3), state

or federal law.

3.08.020 – Proceeds – Use. The net proceeds from the taxes collected by the city pursuant to this chapter shall be used for general purposes relating to services, health and welfare of

.

the City of Whittier, and in administration of the city government

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1