Form F-1157z - Certificate Of Eligibility For Corporate Income Tax

ADVERTISEMENT

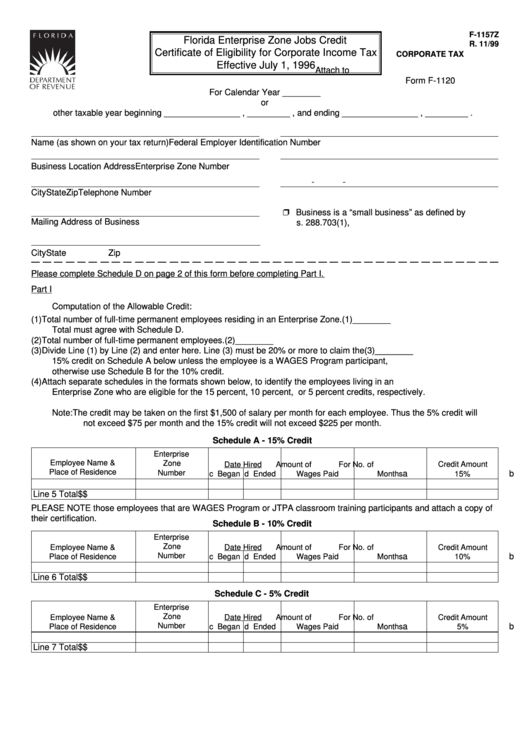

F-1157Z

Florida Enterprise Zone Jobs Credit

R. 11/99

Certificate of Eligibility for Corporate Income Tax

CORPORATE TAX

Effective July 1, 1996

Attach to

Form F-1120

For Calendar Year ________

or

other taxable year beginning ________________ , _________ , and ending ________________ , _________ .

Name (as shown on your tax return)

Federal Employer Identification Number

Business Location Address

Enterprise Zone Number

-

-

City

State

Zip

Telephone Number

Business is a “small business” as defined by

Mailing Address of Business

s. 288.703(1), F.S.

City

State

Zip

Please complete Schedule D on page 2 of this form before completing Part I.

Part I

Computation of the Allowable Credit:

(1)

Total number of full-time permanent employees residing in an Enterprise Zone.

(1)

________

Total must agree with Schedule D.

(2)

Total number of full-time permanent employees.

(2)

________

(3)

Divide Line (1) by Line (2) and enter here. Line (3) must be 20% or more to claim the

(3)

________

15% credit on Schedule A below unless the employee is a WAGES Program participant,

otherwise use Schedule B for the 10% credit.

(4)

Attach separate schedules in the formats shown below, to identify the employees living in an

Enterprise Zone who are eligible for the 15 percent, 10 percent, or 5 percent credits, respectively.

Note:

The credit may be taken on the first $1,500 of salary per month for each employee. Thus the 5% credit will

not exceed $75 per month and the 15% credit will not exceed $225 per month.

Schedule A - 15% Credit

Enterprise

Employee Name &

Zone

Date Hired

Amount of

For No. of

Credit Amount

Place of Residence

Number

a

b

e

f

g

c Began d Ended

Wages Paid

Months

15%

Line 5 Total

$

$

PLEASE NOTE those employees that are WAGES Program or JTPA classroom training participants and attach a copy of

their certification.

Schedule B - 10% Credit

Enterprise

Zone

Employee Name &

Date Hired

Amount of

For No. of

Credit Amount

Number

a

b

e

f

g

Place of Residence

c Began d Ended

Wages Paid

Months

10%

Line 6 Total

$

$

Schedule C - 5% Credit

Enterprise

Zone

Employee Name &

Date Hired

Amount of

For No. of

Credit Amount

Number

a

b

e

f

g

Place of Residence

c Began d Ended

Wages Paid

Months

5%

Line 7 Total

$

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2