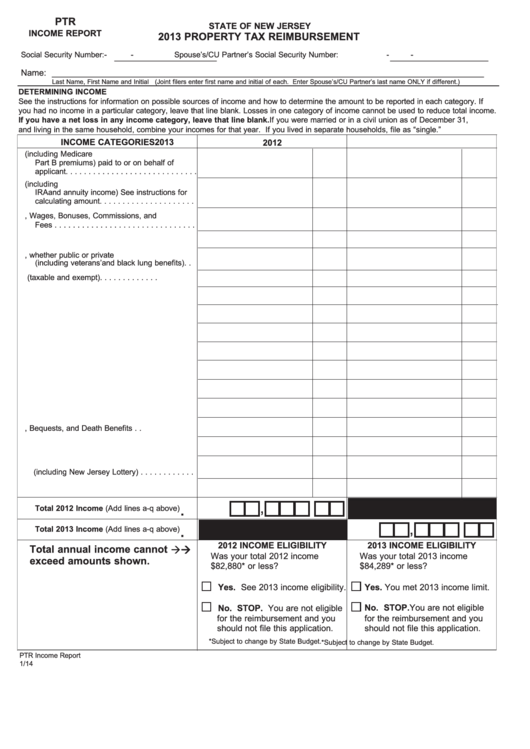

PTR

STATE OF NEW JERSEY

INCOME REPORT

2013 PROPERTY TAX REIMBURSEMENT

Social Security Number:

-

-

Spouse’s/CU Partner’s Social Security Number:

-

-

________________________

_______________________

Name: ___________________________________________________________________________________________

Last Name, First Name and Initial (Joint filers enter first name and initial of each. Enter Spouse’s/CU Partner’s last name ONLY if different.)

DETERMINING INCOME

See the instructions for information on possible sources of income and how to determine the amount to be reported in each category. If

you had no income in a particular category, leave that line blank. Losses in one category of income cannot be used to reduce total income.

If you have a net loss in any income category, leave that line blank. If you were married or in a civil union as of December 31,

and living in the same household, combine your incomes for that year. If you lived in separate households, file as “single.”

INCOME CATEGORIES

2012

2013

a. Social Security Benefits (including Medicare

Part B premiums) paid to or on behalf of

applicant. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b. Pension and Retirement Benefits (including

IRA and annuity income) See instructions for

calculating amount. . . . . . . . . . . . . . . . . . . . .

c. Salaries, Wages, Bonuses, Commissions, and

Fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d. Unemployment Benefits . . . . . . . . . . . . . . . . .

e. Disability Benefits, whether public or private

(including veterans’ and black lung benefits). .

f. Interest (taxable and exempt). . . . . . . . . . . . .

g. Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . .

h. Capital Gains . . . . . . . . . . . . . . . . . . . . . . . .

i. Net Rental Income . . . . . . . . . . . . . . . . . . . .

j. Net Profits From Business . . . . . . . . . . . . . . .

k. Net Distributive Share of Partnership Income .

l. Net Pro Rata Share of S Corporation Income .

m. Support Payments . . . . . . . . . . . . . . . . . . . . .

n. Inheritances, Bequests, and Death Benefits . .

o. Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . .

p. Gambling and Lottery Winnings

(including New Jersey Lottery) . . . . . . . . . . . .

q. All Other Income . . . . . . . . . . . . . . . . . . . . . .

,

.

Total 2012 Income (Add lines a-q above)

,

.

Total 2013 Income (Add lines a-q above)

2013 INCOME ELIGIBILITY

2012 INCOME ELIGIBILITY

Total annual income cannot

Was your total 2012 income

Was your total 2013 income

exceed amounts shown.

$82,880* or less?

$84,289* or less?

Yes. See 2013 income eligibility.

Yes. You met 2013 income limit.

No. STOP. You are not eligible

No. STOP. You are not eligible

for the reimbursement and you

for the reimbursement and you

should not file this application.

should not file this application.

*Subject to change by State Budget.

*Subject to change by State Budget.

PTR Income Report

1/14

1

1