Gross Sales Reporting Form - City Of Baton Rouge

ADVERTISEMENT

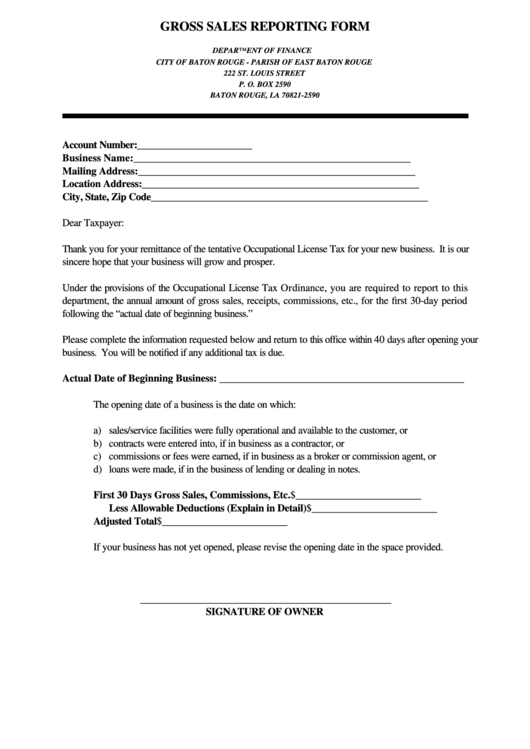

GROSS SALES REPORTING FORM

DEPARTMENT OF FINANCE

CITY OF BATON ROUGE - PARISH OF EAST BATON ROUGE

222 ST. LOUIS STREET

P. O. BOX 2590

BATON ROUGE, LA 70821-2590

Account Number:

______________________

Business Name:

_____________________________________________________

Mailing Address:

_____________________________________________________

Location Address:

_____________________________________________________

City, State, Zip Code _____________________________________________________

Dear Taxpayer:

Thank you for your remittance of the tentative Occupational License Tax for your new business. It is our

sincere hope that your business will grow and prosper.

Under the provisions of the Occupational License Tax Ordinance, you are required to report to this

department, the annual amount of gross sales, receipts, commissions, etc., for the first 30-day period

following the “actual date of beginning business.”

Please complete the information requested below and return to this office within 40 days after opening your

business. You will be notified if any additional tax is due.

Actual Date of Beginning Business: _______________________________________________

The opening date of a business is the date on which:

a) sales/service facilities were fully operational and available to the customer, or

b) contracts were entered into, if in business as a contractor, or

c) commissions or fees were earned, if in business as a broker or commission agent, or

d) loans were made, if in the business of lending or dealing in notes.

First 30 Days Gross Sales, Commissions, Etc.

$________________________

Less Allowable Deductions (Explain in Detail)

$________________________

Adjusted Total

$________________________

If your business has not yet opened, please revise the opening date in the space provided.

________________________________________________

SIGNATURE OF OWNER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1