Application For Occupational License And Sales Tax Registration - City Of Baton Rouge

ADVERTISEMENT

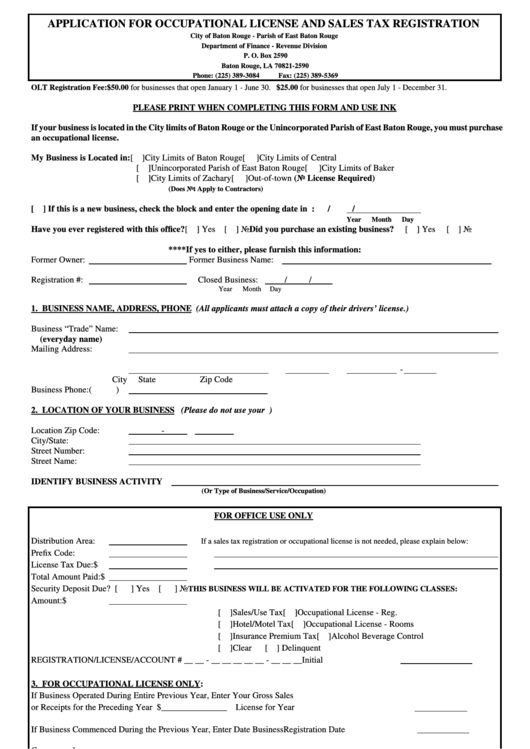

APPLICATION FOR OCCUPATIONAL LICENSE AND SALES TAX REGISTRATION

City of Baton Rouge - Parish of East Baton Rouge

Department of Finance - Revenue Division

P. O. Box 2590

Baton Rouge, LA 70821-2590

Phone: (225) 389-3084

Fax: (225) 389-5369

OLT Registration Fee: $50.00 for businesses that open January 1 - June 30. $25.00 for businesses that open July 1 - December 31.

PLEASE PRINT WHEN COMPLETING THIS FORM AND USE INK

If your business is located in the City limits of Baton Rouge or the Unincorporated Parish of East Baton Rouge, you must purchase

an occupational license.

My Business is Located in: [ ] City Limits of Baton Rouge

[

] City Limits of Central

[ ] Unincorporated Parish of East Baton Rouge

[

] City Limits of Baker

[ ] City Limits of Zachary

[

] Out-of-town (No License Required)

(Does Not Apply to Contractors)

[ ] If this is a new business, check the block and enter the opening date in E.B.R.P.:

/

/

Year

Month

Day

Have you ever registered with this office?

[ ] Yes [ ] No Did you purchase an existing business?

[ ] Yes

[ ] No

****If yes to either, please furnish this information:

Former Owner:

Former Business Name:

Registration #:

Closed Business:

/

/

Year

Month

Day

1. BUSINESS NAME, ADDRESS, PHONE (All applicants must attach a copy of their drivers’ license.)

Business “Trade” Name:

(everyday name)

Mailing Address:

-

City

State

Zip Code

Business Phone:

(

)

2. LOCATION OF YOUR BUSINESS (Please do not use your P.O. Box as the location of your business.)

Location Zip Code:

-

City/State:

Street Number:

Street Name:

IDENTIFY BUSINESS ACTIVITY

(Or Type of Business/Service/Occupation)

FOR OFFICE USE ONLY

Distribution Area:

If a sales tax registration or occupational license is not needed, please explain below:

Prefix Code:

License Tax Due:

$

Total Amount Paid:

$

Security Deposit Due? [

] Yes [

] No

THIS BUSINESS WILL BE ACTIVATED FOR THE FOLLOWING CLASSES:

Amount:

$

[ ] Sales/Use Tax

[ ] Occupational License - Reg.

[ ] Hotel/Motel Tax

[ ] Occupational License - Rooms

[ ] Insurance Premium Tax

[ ] Alcohol Beverage Control

[ ] Clear

[ ] Delinquent

REGISTRATION/LICENSE/ACCOUNT # __ __ - __ __ __ __ __ - __ __ __

Initial

3. FOR OCCUPATIONAL LICENSE ONLY:

If Business Operated During Entire Previous Year, Enter Your Gross Sales

or Receipts for the Preceding Year $_______________

License for Year

If Business Commenced During the Previous Year, Enter Date Business

Registration Date

Commenced ___________________.

Gross Sales for the Remainder of the Calendar Year:

$_______________

Divided by the Number of Days Left in the Year Equals:

$_______________

Which Multiplied by 365 Amounts to:

$_______________

Base Tax:$_______________

Penalty: $_______________

Interest: $_______________

Total Due:$_______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2