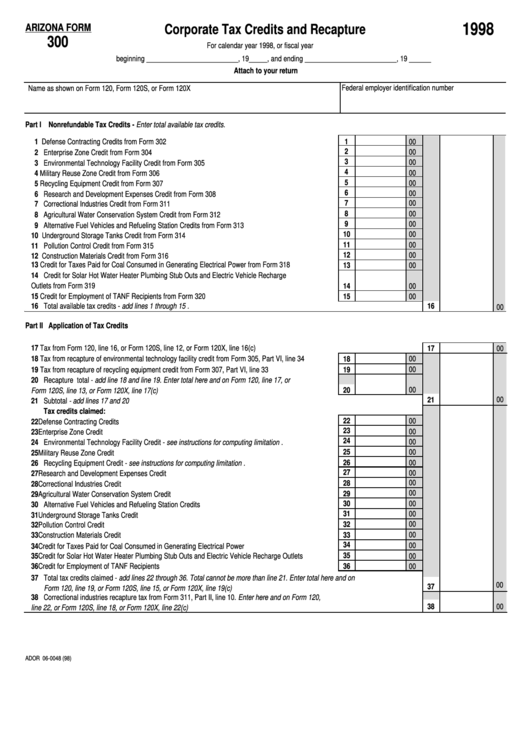

1998

ARIZONA FORM

Corporate Tax Credits and Recapture

300

For calendar year 1998, or fiscal year

beginning _________________________, 19_____, and ending _________________________, 19 ______

Attach to your return

Federal employer identification number

Name as shown on Form 120, Form 120S, or Form 120X

Part I Nonrefundable Tax Credits - Enter total available tax credits.

1 Defense Contracting Credits from Form 302 ............................................................................................

1

00

2

00

2 Enterprise Zone Credit from Form 304 .....................................................................................................

3

00

3 Environmental Technology Facility Credit from Form 305 ........................................................................

4

00

4 Military Reuse Zone Credit from Form 306 ...............................................................................................

5

00

5 Recycling Equipment Credit from Form 307 .............................................................................................

6

00

6 Research and Development Expenses Credit from Form 308 .................................................................

7

00

7 Correctional Industries Credit from Form 311 ...........................................................................................

8

00

8 Agricultural Water Conservation System Credit from Form 312 ...............................................................

9

00

9 Alternative Fuel Vehicles and Refueling Station Credits from Form 313 ..................................................

10

00

10 Underground Storage Tanks Credit from Form 314 .................................................................................

11

00

11 Pollution Control Credit from Form 315 ....................................................................................................

12

00

12 Construction Materials Credit from Form 316 ...........................................................................................

13 Credit for Taxes Paid for Coal Consumed in Generating Electrical Power from Form 318 .....................

13

00

14 Credit for Solar Hot Water Heater Plumbing Stub Outs and Electric Vehicle Recharge

Outlets from Form 319 ..............................................................................................................................

14

00

15 Credit for Employment of TANF Recipients from Form 320 .....................................................................

15

00

16 Total available tax credits - add lines 1 through 15 ..................................................................................................................................

16

00

Part II Application of Tax Credits

17 Tax from Form 120, line 16, or Form 120S, line 12, or Form 120X, line 16(c) .........................................................................................

17

00

18 Tax from recapture of environmental technology facility credit from Form 305, Part VI, line 34 ..............

00

18

00

19 Tax from recapture of recycling equipment credit from Form 307, Part VI, line 33 ..................................

19

20 Recapture total - add line 18 and line 19. Enter total here and on Form 120, line 17, or

20

00

Form 120S, line 13, or Form 120X, line 17(c) ...........................................................................................

00

21

21 Subtotal - add lines 17 and 20 ..................................................................................................................................................................

Tax credits claimed:

22

00

22 Defense Contracting Credits .....................................................................................................................

23

00

23 Enterprise Zone Credit ..............................................................................................................................

24

00

24 Environmental Technology Facility Credit - see instructions for computing limitation ..............................

25

00

25 Military Reuse Zone Credit .......................................................................................................................

26

00

26 Recycling Equipment Credit - see instructions for computing limitation ...................................................

27

00

27 Research and Development Expenses Credit ..........................................................................................

00

28

28 Correctional Industries Credit ....................................................................................................................

00

29

29 Agricultural Water Conservation System Credit ........................................................................................

30

00

30 Alternative Fuel Vehicles and Refueling Station Credits ...........................................................................

31

00

31 Underground Storage Tanks Credit ..........................................................................................................

00

32 Pollution Control Credit .............................................................................................................................

32

00

33 Construction Materials Credit ....................................................................................................................

33

34

00

34 Credit for Taxes Paid for Coal Consumed in Generating Electrical Power ...............................................

35

35 Credit for Solar Hot Water Heater Plumbing Stub Outs and Electric Vehicle Recharge Outlets ..............

00

36 Credit for Employment of TANF Recipients ..............................................................................................

36

00

37 Total tax credits claimed - add lines 22 through 36. Total cannot be more than line 21. Enter total here and on

00

37

Form 120, line 19, or Form 120S, line 15, or Form 120X, line 19(c) .........................................................................................................

38 Correctional industries recapture tax from Form 311, Part II, line 10. Enter here and on Form 120,

38

00

line 22, or Form 120S, line 18, or Form 120X, line 22(c) .........................................................................................................................

ADOR 06-0048 (98)

1

1