Print

Reset form

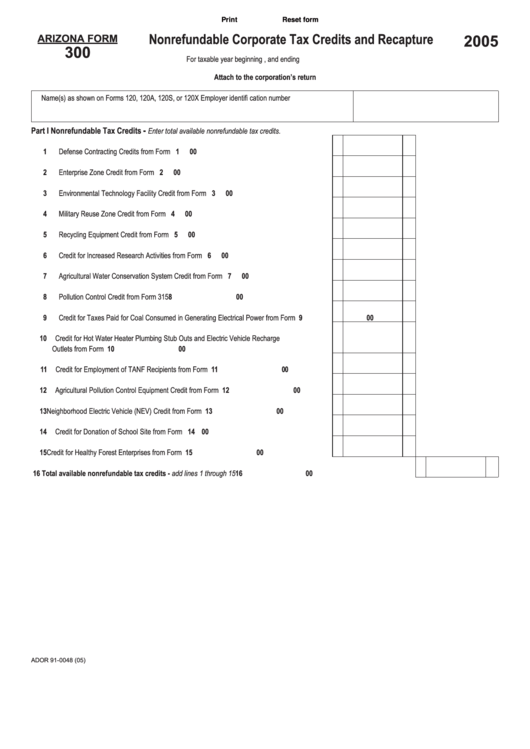

2005

ARIZONA FORM

Nonrefundable Corporate Tax Credits and Recapture

300

For taxable year beginning

, and ending

Attach to the corporation’s return

Name(s) as shown on Forms 120, 120A, 120S, or 120X

Employer identifi cation number

-

Part I

Nonrefundable Tax Credits

Enter total available nonrefundable tax credits.

1 Defense Contracting Credits from Form 302 ....................................................................................

1

00

2 Enterprise Zone Credit from Form 304 .............................................................................................

2

00

3 Environmental Technology Facility Credit from Form 305 ................................................................

3

00

4 Military Reuse Zone Credit from Form 306.......................................................................................

4

00

5 Recycling Equipment Credit from Form 307.....................................................................................

5

00

6 Credit for Increased Research Activities from Form 308 ..................................................................

6

00

7 Agricultural Water Conservation System Credit from Form 312 .......................................................

7

00

8 Pollution Control Credit from Form 315 ............................................................................................

8

00

9 Credit for Taxes Paid for Coal Consumed in Generating Electrical Power from Form 318...............

9

00

10 Credit for Hot Water Heater Plumbing Stub Outs and Electric Vehicle Recharge

Outlets from Form 319...................................................................................................................... 10

00

11 Credit for Employment of TANF Recipients from Form 320..............................................................

11

00

12 Agricultural Pollution Control Equipment Credit from Form 325 ....................................................... 12

00

13 Neighborhood Electric Vehicle (NEV) Credit from Form 328............................................................ 13

00

14 Credit for Donation of School Site from Form 331............................................................................ 14

00

15 Credit for Healthy Forest Enterprises from Form 332....................................................................... 15

00

16 Total available nonrefundable tax credits - add lines 1 through 15.............................................................................................

16

00

ADOR 91-0048 (05)

1

1 2

2