Form Rct-105 - Three-Factor Capital Stock/foreign Franchise Tax Manufacturing Exemption Schedule

ADVERTISEMENT

Page 1

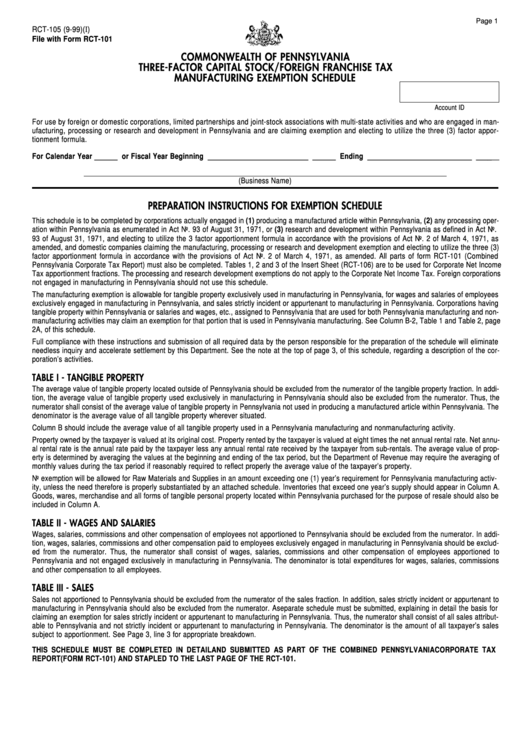

RCT-105 (9-99)(I)

File with Form RCT-101

COMMONWEALTH OF PENNSYLVANIA

THREE-FACTOR CAPITAL STOCK/FOREIGN FRANCHISE TAX

MANUFACTURING EXEMPTION SCHEDULE

Account ID

For use by foreign or domestic corporations, limited partnerships and joint-stock associations with multi-state activities and who are engaged in man-

ufacturing, processing or research and development in Pennsylvania and are claiming exemption and electing to utilize the three (3) factor appor-

tionment formula.

For Calendar Year ______ or Fiscal Year Beginning __________________________ ______ Ending ___________________________ ______

(Business Name)

PREPARATION INSTRUCTIONS FOR EXEMPTION SCHEDULE

T

his schedule is to be completed by corporations actually engaged in (1) producing a manufactured article within Pennsylvania, (2) any processing oper-

ation within Pennsylvania as enumerated in Act No. 93 of August 31, 1971, or (3) research and development within Pennsylvania as defined in Act No.

93 of August 31, 1971, and electing to utilize the 3 factor apportionment formula in accordance with the provisions of Act No. 2 of March 4, 1971, as

amended, and domestic companies claiming the manufacturing, processing or research and development exemption and electing to utilize the three (3)

factor apportionment formula in accordance with the provisions of Act No. 2 of March 4, 1971, as amended. All parts of form RCT-101 (Combined

Pennsylvania Corporate Tax Report) must also be completed. Tables 1, 2 and 3 of the Insert Sheet (RCT-106) are to be used for Corporate Net Income

Tax apportionment fractions. The processing and research development exemptions do not apply to the Corporate Net Income Tax. Foreign corporations

not engaged in manufacturing in Pennsylvania should not use this schedule.

The manufacturing exemption is allowable for tangible property exclusively used in manufacturing in Pennsylvania, for wages and salaries of employees

exclusively engaged in manufacturing in Pennsylvania, and sales strictly incident or appurtenant to manufacturing in Pennsylvania. Corporations having

tangible property within Pennsylvania or salaries and wages, etc., assigned to Pennsylvania that are used for both Pennsylvania manufacturing and non-

manufacturing activities may claim an exemption for that portion that is used in Pennsylvania manufacturing. See Column B-2, Table 1 and Table 2, page

2A, of this schedule.

Full compliance with these instructions and submission of all required data by the person responsible for the preparation of the schedule will eliminate

needless inquiry and accelerate settlement by this Department. See the note at the top of page 3, of this schedule, regarding a description of the cor-

poration’s activities.

TABLE I - TANGIBLE PROPERTY

The average value of tangible property located outside of Pennsylvania should be excluded from the numerator of the tangible property fraction. In addi-

tion, the average value of tangible property used exclusively in manufacturing in Pennsylvania should also be excluded from the numerator. Thus, the

numerator shall consist of the average value of tangible property in Pennsylvania not used in producing a manufactured article within Pennsylvania. The

denominator is the average value of all tangible property wherever situated.

Column B should include the average value of all tangible property used in a Pennsylvania manufacturing and nonmanufacturing activity.

Property owned by the taxpayer is valued at its original cost. Property rented by the taxpayer is valued at eight times the net annual rental rate. Net annu-

al rental rate is the annual rate paid by the taxpayer less any annual rental rate received by the taxpayer from sub-rentals. The average value of prop-

erty is determined by averaging the values at the beginning and ending of the tax period, but the Department of Revenue may require the averaging of

monthly values during the tax period if reasonably required to reflect properly the average value of the taxpayer’s property.

No exemption will be allowed for Raw Materials and Supplies in an amount exceeding one (1) year’s requirement for Pennsylvania manufacturing activ-

ity, unless the need therefore is properly substantiated by an attached schedule. Inventories that exceed one year’s supply should appear in Column A.

Goods, wares, merchandise and all forms of tangible personal property located within Pennsylvania purchased for the purpose of resale should also be

included in Column A.

TABLE II - WAGES AND SALARIES

Wages, salaries, commissions and other compensation of employees not apportioned to Pennsylvania should be excluded from the numerator. In addi-

tion, wages, salaries, commissions and other compensation paid to employees exclusively engaged in manufacturing in Pennsylvania should be exclud-

ed from the numerator. Thus, the numerator shall consist of wages, salaries, commissions and other compensation of employees apportioned to

Pennsylvania and not engaged exclusively in manufacturing in Pennsylvania. The denominator is total expenditures for wages, salaries, commissions

and other compensation to all employees.

TABLE III - SALES

Sales not apportioned to Pennsylvania should be excluded from the numerator of the sales fraction. In addition, sales strictly incident or appurtenant to

manufacturing in Pennsylvania should also be excluded from the numerator. A separate schedule must be submitted, explaining in detail the basis for

claiming an exemption for sales strictly incident or appurtenant to manufacturing in Pennsylvania. Thus, the numerator shall consist of all sales attribut-

able to Pennsylvania and not strictly incident or appurtenant to manufacturing in Pennsylvania. The denominator is the amount of all taxpayer’s sales

subject to apportionment. See Page 3, line 3 for appropriate breakdown.

THIS SCHEDULE MUST BE COMPLETED IN DETAIL AND SUBMITTED AS PART OF THE COMBINED PENNSYLVANIA CORPORATE TAX

REPORT(FORM RCT-101) AND STAPLED TO THE LAST PAGE OF THE RCT-101.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4