Instructions For Form Hs-136 Adjustment Schedule - Vermont Department Of Taxes

ADVERTISEMENT

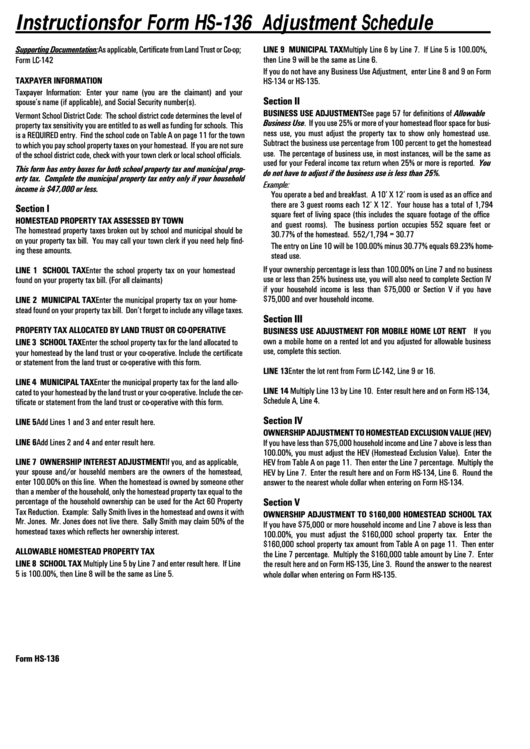

Instructions for Form HS-136 Adjustment Schedule

Supporting Documentation: As applicable, Certificate from Land Trust or Co-op;

LINE 9 MUNICIPAL TAX Multiply Line 6 by Line 7. If Line 5 is 100.00%,

Form LC-142

then Line 9 will be the same as Line 6.

If you do not have any Business Use Adjustment, enter Line 8 and 9 on Form

TAXPAYER INFORMATION

HS-134 or HS-135.

Taxpayer Information: Enter your name (you are the claimant) and your

Section II

spouse’s name (if applicable), and Social Security number(s).

BUSINESS USE ADJUSTMENT See page 57 for definitions of Allowable

Vermont School District Code: The school district code determines the level of

Business Use. If you use 25% or more of your homestead floor space for busi-

property tax sensitivity you are entitled to as well as funding for schools. This

ness use, you must adjust the property tax to show only homestead use.

is a REQUIRED entry. Find the school code on Table A on page 11 for the town

Subtract the business use percentage from 100 percent to get the homestead

to which you pay school property taxes on your homestead. If you are not sure

use. The percentage of business use, in most instances, will be the same as

of the school district code, check with your town clerk or local school officials.

used for your Federal income tax return when 25% or more is reported. You

This form has entry boxes for both school property tax and municipal prop-

do not have to adjust if the business use is less than 25%.

erty tax. Complete the municipal property tax entry only if your household

Example:

income is $47,000 or less.

You operate a bed and breakfast. A 10’ X 12’ room is used as an office and

there are 3 guest rooms each 12’ X 12’. Your house has a total of 1,794

Section I

square feet of living space (this includes the square footage of the office

HOMESTEAD PROPERTY TAX ASSESSED BY TOWN

and guest rooms). The business portion occupies 552 square feet or

The homestead property taxes broken out by school and municipal should be

30.77% of the homestead. 552/1,794 = 30.77

on your property tax bill. You may call your town clerk if you need help find-

The entry on Line 10 will be 100.00% minus 30.77% equals 69.23% home-

ing these amounts.

stead use.

If your ownership percentage is less than 100.00% on Line 7 and no business

LINE 1 SCHOOL TAX Enter the school property tax on your homestead

use or less than 25% business use, you will also need to complete Section IV

found on your property tax bill. (For all claimants)

if your household income is less than $75,000 or Section V if you have

$75,000 and over household income.

LINE 2 MUNICIPAL TAX Enter the municipal property tax on your home-

stead found on your property tax bill. Don’t forget to include any village taxes.

Section III

PROPERTY TAX ALLOCATED BY LAND TRUST OR CO-OPERATIVE

BUSINESS USE ADJUSTMENT FOR MOBILE HOME LOT RENT If you

own a mobile home on a rented lot and you adjusted for allowable business

LINE 3 SCHOOL TAX Enter the school property tax for the land allocated to

use, complete this section.

your homestead by the land trust or your co-operative. Include the certificate

or statement from the land trust or co-operative with this form.

LINE 13 Enter the lot rent from Form LC-142, Line 9 or 16.

LINE 4 MUNICIPAL TAX Enter the municipal property tax for the land allo-

LINE 14 Multiply Line 13 by Line 10. Enter result here and on Form HS-134,

cated to your homestead by the land trust or your co-operative. Include the cer-

Schedule A, Line 4.

tificate or statement from the land trust or co-operative with this form.

Section IV

LINE 5 Add Lines 1 and 3 and enter result here.

OWNERSHIP ADJUSTMENT TO HOMESTEAD EXCLUSION VALUE (HEV)

LINE 6 Add Lines 2 and 4 and enter result here.

If you have less than $75,000 household income and Line 7 above is less than

100.00%, you must adjust the HEV (Homestead Exclusion Value). Enter the

LINE 7 OWNERSHIP INTEREST ADJUSTMENT If you, and as applicable,

HEV from Table A on page 11. Then enter the Line 7 percentage. Multiply the

your spouse and/or househld members are the owners of the homestead,

HEV by Line 7. Enter the result here and on Form HS-134, Line 6. Round the

enter 100.00% on this line. When the homestead is owned by someone other

answer to the nearest whole dollar when entering on Form HS-134.

than a member of the household, only the homestead property tax equal to the

percentage of the household ownership can be used for the Act 60 Property

Section V

Tax Reduction. Example: Sally Smith lives in the homestead and owns it with

OWNERSHIP ADJUSTMENT TO $160,000 HOMESTEAD SCHOOL TAX

Mr. Jones. Mr. Jones does not live there. Sally Smith may claim 50% of the

If you have $75,000 or more household income and Line 7 above is less than

homestead taxes which reflects her ownership interest.

100.00%, you must adjust the $160,000 school property tax. Enter the

$160,000 school property tax amount from Table A on page 11. Then enter

ALLOWABLE HOMESTEAD PROPERTY TAX

the Line 7 percentage. Multiply the $160,000 table amount by Line 7. Enter

LINE 8 SCHOOL TAX Multiply Line 5 by Line 7 and enter result here. If Line

the result here and on Form HS-135, Line 3. Round the answer to the nearest

5 is 100.00%, then Line 8 will be the same as Line 5.

whole dollar when entering on Form HS-135.

Form HS-136

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1