Instructions For Wisconsin Form W-Ra - Required Attachments For Electronic Filing

ADVERTISEMENT

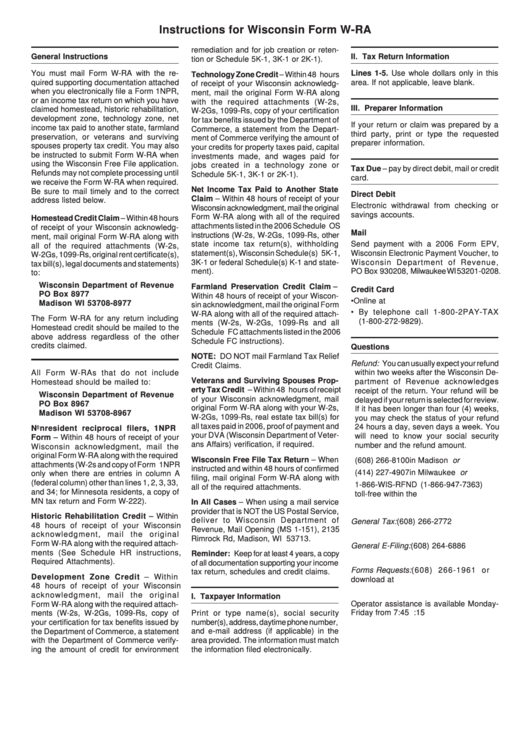

Instructions for Wisconsin Form W-RA

remediation and for job creation or reten-

General Instructions

II. Tax Return Information

tion or Schedule 5K-1, 3K-1 or 2K-1).

You must mail Form W-RA with the re-

Lines 1-5. Use whole dollars only in this

Technology Zone Credit – Within 48 hours

quired supporting documentation attached

area. If not applicable, leave blank.

of receipt of your Wisconsin acknowledg-

when you electronically file a Form 1NPR,

ment, mail the original Form W-RA along

or an income tax return on which you have

with the required attachments (W-2s,

III. Preparer Information

claimed homestead, historic rehabilitation,

W-2Gs, 1099-Rs, copy of your certification

development zone, technology zone, net

for tax benefits issued by the Department of

If your return or claim was prepared by a

income tax paid to another state, farmland

Commerce, a statement from the Depart-

third party, print or type the requested

preservation, or veterans and surviving

ment of Commerce verifying the amount of

preparer information.

spouses property tax credit. You may also

your credits for property taxes paid, capital

be instructed to submit Form W-RA when

investments made, and wages paid for

using the Wisconsin Free File application.

jobs created in a technology zone or

Tax Due – pay by direct debit, mail or credit

Refunds may not complete processing until

Schedule 5K-1, 3K-1 or 2K-1).

card.

we receive the Form W-RA when required.

Net Income Tax Paid to Another State

Be sure to mail timely and to the correct

Direct Debit

Claim – Within 48 hours of receipt of your

address listed below.

Electronic withdrawal from checking or

Wisconsin acknowledgment, mail the original

savings accounts.

Form W-RA along with all of the required

Homestead Credit Claim – Within 48 hours

attachments listed in the 2006 Schedule OS

of receipt of your Wisconsin acknowledg-

Mail

instructions (W-2s, W-2Gs, 1099-Rs, other

ment, mail original Form W-RA along with

state income tax return(s), withholding

Send payment with a 2006 Form EPV,

all of the required attachments (W-2s,

statement(s), Wisconsin Schedule(s) 5K-1,

Wisconsin Electronic Payment Voucher, to

W-2Gs, 1099-Rs, original rent certificate(s),

3K-1 or federal Schedule(s) K-1 and state-

Wisconsin Department of Revenue,

tax bill(s), legal documents and statements)

ment).

PO Box 930208, Milwaukee WI 53201-0208.

to:

Wisconsin Department of Revenue

Farmland Preservation Credit Claim –

Credit Card

PO Box 8977

Within 48 hours of receipt of your Wiscon-

• Online at

Madison WI 53708-8977

sin acknowledgment, mail the original Form

• By telephone call 1-800-2PAY-TAX

W-RA along with all of the required attach-

The Form W-RA for any return including

(1-800-272-9829).

ments (W-2s, W-2Gs, 1099-Rs and all

Homestead credit should be mailed to the

Schedule FC attachments listed in the 2006

above address regardless of the other

Schedule FC instructions).

credits claimed.

Questions

NOTE: DO NOT mail Farmland Tax Relief

Refund: You can usually expect your refund

Credit Claims.

within two weeks after the Wisconsin De-

All Form W-RAs that do not include

Veterans and Surviving Spouses Prop-

Homestead should be mailed to:

partment of Revenue acknowledges

erty Tax Credit – Within 48 hours of receipt

receipt of the return. Your refund will be

Wisconsin Department of Revenue

of your Wisconsin acknowledgment, mail

delayed if your return is selected for review.

PO Box 8967

original Form W-RA along with your W-2s,

If it has been longer than four (4) weeks,

Madison WI 53708-8967

W-2Gs, 1099-Rs, real estate tax bill(s) for

you may check the status of your refund

all taxes paid in 2006, proof of payment and

24 hours a day, seven days a week. You

Nonresident reciprocal filers, 1NPR

your DVA (Wisconsin Department of Veter-

will need to know your social security

Form – Within 48 hours of receipt of your

ans Affairs) verification, if required.

number and the refund amount.

Wisconsin acknowledgment, mail the

original Form W-RA along with the required

Wisconsin Free File Tax Return – When

(608) 266-8100

in Madison or

attachments (W-2s and copy of Form 1NPR

instructed and within 48 hours of confirmed

(414) 227-4907

in Milwaukee or

only when there are entries in column A

filing, mail original Form W-RA along with

(federal column) other than lines 1, 2, 3, 33,

1-866-WIS-RFND (1-866-947-7363)

all of the required attachments.

and 34; for Minnesota residents, a copy of

toll-free within the U.S. or Canada

MN tax return and Form W-222).

In All Cases – When using a mail service

provider that is NOT the US Postal Service,

Historic Rehabilitation Credit – Within

deliver to Wisconsin Department of

General Tax:

(608) 266-2772

48 hours of receipt of your Wisconsin

Revenue, Mail Opening (MS 1-151), 2135

income@dor.state.wi.us

acknowledgment, mail the original

Rimrock Rd, Madison, WI 53713.

Form W-RA along with the required attach-

General E-Filing:

(608) 264-6886

ments (See Schedule HR instructions,

Reminder: Keep for at least 4 years, a copy

efiling@dor.state.wi.us

Required Attachments).

of all documentation supporting your income

Forms Requests:

(608) 266-1961 or

tax return, schedules and credit claims.

Development Zone Credit – Within

download at

48 hours of receipt of your Wisconsin

acknowledgment, mail the original

I. Taxpayer Information

Operator assistance is available Monday-

Form W-RA along with the required attach-

Friday from 7:45 a.m. to 4:15 p.m.

ments (W-2s, W-2Gs, 1099-Rs, copy of

Print or type name(s), social security

your certification for tax benefits issued by

number(s), address, daytime phone number,

the Department of Commerce, a statement

and e-mail address (if applicable) in the

with the Department of Commerce verify-

area provided. The information must match

ing the amount of credit for environment

the information filed electronically.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1