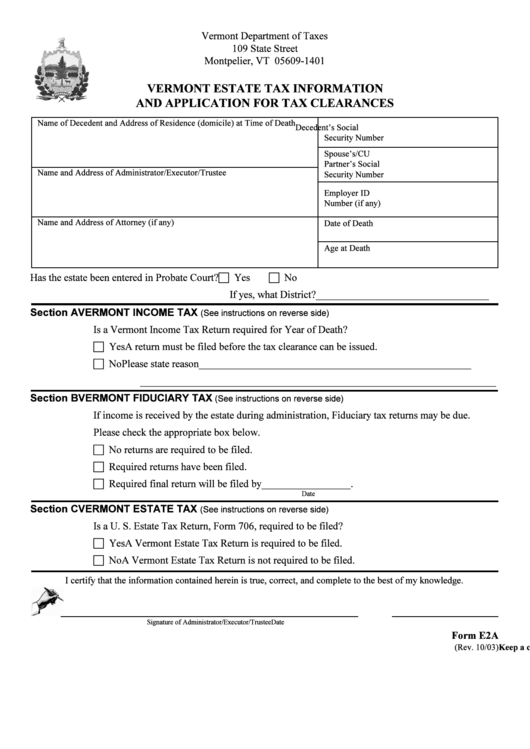

Form E2a - Vermont Estate Tax Information And Application For Tax Clearances

ADVERTISEMENT

VERMONT ESTATE TAX INFORMATION

AND APPLICATION FOR TAX CLEARANCES

Name of Decedent and Address of Residence (domicile) at Time of Death

Decedent’s Social

Security Number

Spouse’s/CU

Partner’s Social

Name and Address of Administrator/Executor/Trustee

Security Number

Employer ID

Number (if any)

Name and Address of Attorney (if any)

Date of Death

Age at Death

c

c

Section A

VERMONT INCOME TAX

(See instructions on reverse side)

c

c

Section B

VERMONT FIDUCIARY TAX

(See instructions on reverse side)

c

c

c

Date

Section C

VERMONT ESTATE TAX

(See instructions on reverse side)

c

c

I certify that the information contained herein is true, correct, and complete to the best of my knowledge.

Signature of Administrator/Executor/Trustee

Date

Form E2A

Keep a copy for your records.

(Rev. 10/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1