Form Ct-8 - Claim For Credit Or Refund Of Corporation Tax Paid

ADVERTISEMENT

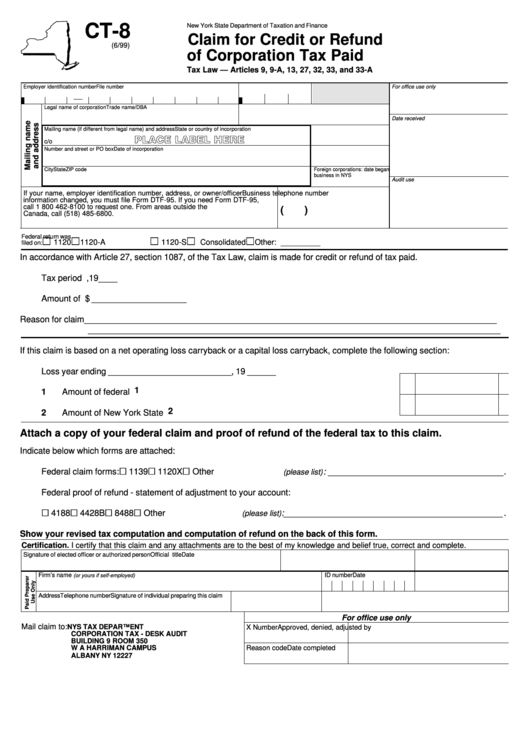

CT-8

New York State Department of Taxation and Finance

Claim for Credit or Refund

(6/99)

of Corporation Tax Paid

Tax Law — Articles 9, 9-A, 13, 27, 32, 33, and 33-A

Employer identification number

File number

For office use only

Legal name of corporation

Trade name/DBA

Date received

Mailing name (if different from legal name) and address

State or country of incorporation

PLACE LABEL HERE

c/o

Number and street or PO box

Date of incorporation

City

State

ZIP code

Foreign corporations: date began

business in NYS

Audit use

If your name, employer identification number, address, or owner/officer

Business telephone number

information changed, you must file Form DTF-95. If you need Form DTF-95,

call 1 800 462-8100 to request one. From areas outside the U.S. and outside

(

)

Canada, call (518) 485-6800.

Federal return was

G

G

G

G

G

1120

1120-A

1120-S

Consolidated

Other: _________

filed on:

In accordance with Article 27, section 1087, of the Tax Law, claim is made for credit or refund of tax paid.

Tax period ending ....................................................................................................................... _______________ ,19____

Amount of claim ......................................................................................................................... $ ____________________

Reason for claim _______________________________________________________________________________________

_______________________________________________________________________________________

If this claim is based on a net operating loss carryback or a capital loss carryback, complete the following section:

Loss year ending __________________________, 19 ______

1

1

Amount of federal loss .......................................................................................................

2

2

Amount of New York State loss .........................................................................................

Attach a copy of your federal claim and proof of refund of the federal tax to this claim.

Indicate below which forms are attached:

G

G

G

Federal claim forms:

1139

1120X

Other

: ____________________________________ .

(please list)

Federal proof of refund - statement of adjustment to your account:

G

G

G

G

: _____________________________________________ .

4188

4428B

8488

Other

(please list)

Show your revised tax computation and computation of refund on the back of this form.

Certification. I certify that this claim and any attachments are to the best of my knowledge and belief true, correct and complete.

Signature of elected officer or authorized person

Official title

Date

Firm’s name

ID number

Date

(or yours if self-employed)

Address

Telephone number

Signature of individual preparing this claim

For office use only

Mail claim to:

NYS TAX DEPARTMENT

X Number

Approved, denied, adjusted by

CORPORATION TAX - DESK AUDIT

BUILDING 9 ROOM 350

W A HARRIMAN CAMPUS

Reason code

Date completed

ALBANY NY 12227

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2