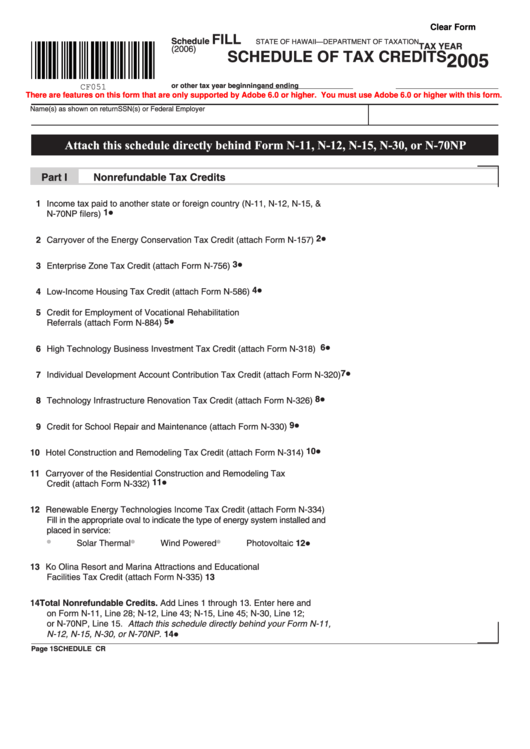

Clear Form

FILL

Schedule

STATE OF HAWAII—DEPARTMENT OF TAXATION

TAX YEAR

(2006)

SCHEDULE OF TAX CREDITS

2005

CF051

or other tax year beginning

and ending

There are features on this form that are only supported by Adobe 6.0 or higher. You must use Adobe 6.0 or higher with this form.

Name(s) as shown on return

SSN(s) or Federal Employer I.D. No.

Attach this schedule directly behind Form N-11, N-12, N-15, N-30, or N-70NP

}

Part I

Nonrefundable Tax Credits

1 Income tax paid to another state or foreign country (N-11, N-12, N-15, &

l

N-70NP filers) ..................................................................................................... 1

l

2 Carryover of the Energy Conservation Tax Credit (attach Form N-157) ........... 2

l

3 Enterprise Zone Tax Credit (attach Form N-756) .............................................. 3

l

4 Low-Income Housing Tax Credit (attach Form N-586) ...................................... 4

5 Credit for Employment of Vocational Rehabilitation

l

Referrals (attach Form N-884) ........................................................................... 5

l

6 High Technology Business Investment Tax Credit (attach Form N-318) .......... 6

l

7 Individual Development Account Contribution Tax Credit (attach Form N-320) 7

8 Technology Infrastructure Renovation Tax Credit (attach Form N-326)............ 8

l

l

9 Credit for School Repair and Maintenance (attach Form N-330) ...................... 9

10 Hotel Construction and Remodeling Tax Credit (attach Form N-314) ............... 10

l

11 Carryover of the Residential Construction and Remodeling Tax

Credit (attach Form N-332) ................................................................................ 11

l

12 Renewable Energy Technologies Income Tax Credit (attach Form N-334)

Fill in the appropriate oval to indicate the type of energy system installed and

placed in service:

=

=

=

•

•

•

l

Solar Thermal

Wind Powered

Photovoltaic ........ 12

13 Ko Olina Resort and Marina Attractions and Educational

Facilities Tax Credit (attach Form N-335) .......................................................... 13

14 Total Nonrefundable Credits. Add Lines 1 through 13. Enter here and

on Form N-11, Line 28; N-12, Line 43; N-15, Line 45; N-30, Line 12;

]

or N-70NP, Line 15. Attach this schedule directly behind your Form N-11,

N-12, N-15, N-30, or N-70NP. ........................................................................... 14

l

Page 1

SCHEDULE CR

1

1 2

2