Form Va-8453 Instructions - Virginia Individual Income Tax Declaration

ADVERTISEMENT

Form VA-8453 (1999)

Page 2

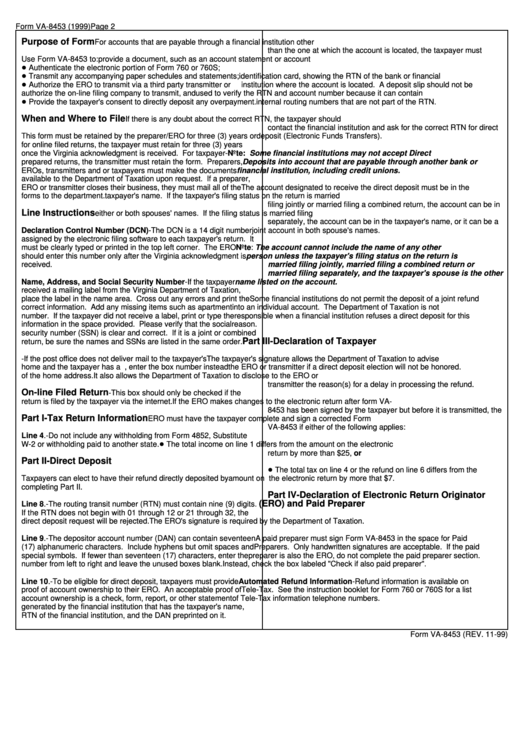

Purpose of Form

For accounts that are payable through a financial institution other

than the one at which the account is located, the taxpayer must

Use Form VA-8453 to:

provide a document, such as an account statement or account

! Authenticate the electronic portion of Form 760 or 760S;

! Transmit any accompanying paper schedules and statements;

identification card, showing the RTN of the bank or financial

! Authorize the ERO to transmit via a third party transmitter or

institution where the account is located. A deposit slip should not be

authorize the on-line filing company to transmit, and

used to verify the RTN and account number because it can contain

! Provide the taxpayer's consent to directly deposit any overpayment.

internal routing numbers that are not part of the RTN.

When and Where to File

If there is any doubt about the correct RTN, the taxpayer should

contact the financial institution and ask for the correct RTN for direct

This form must be retained by the preparer/ERO for three (3) years or

deposit (Electronic Funds Transfers).

for online filed returns, the taxpayer must retain for three (3) years

once the Virginia acknowledgment is received. For taxpayer-

Note: Some financial institutions may not accept Direct

prepared returns, the transmitter must retain the form. Preparers,

Deposits into account that are payable through another bank or

EROs, transmitters and or taxpayers must make the documents

financial institution, including credit unions.

available to the Department of Taxation upon request. If a preparer,

ERO or transmitter closes their business, they must mail all of the

The account designated to receive the direct deposit must be in the

forms to the department.

taxpayer's name. If the taxpayer's filing status on the return is married

filing jointly or married filing a combined return, the account can be in

Line Instructions

either or both spouses' names. If the filing status is married filing

separately, the account can be in the taxpayer's name, or it can be a

Declaration Control Number (DCN)-The DCN is a 14 digit number

joint account in both spouse's names.

assigned by the electronic filing software to each taxpayer's return. It

must be clearly typed or printed in the top left corner. The ERO

Note: The account cannot include the name of any other

should enter this number only after the Virginia acknowledgment is

person unless the taxpayer's filing status on the return is

received.

married filing jointly, married filing a combined return or

married filing separately, and the taxpayer's spouse is the other

Name, Address, and Social Security Number-If the taxpayer

name listed on the account.

received a mailing label from the Virginia Department of Taxation,

place the label in the name area. Cross out any errors and print the

Some financial institutions do not permit the deposit of a joint refund

correct information. Add any missing items such as apartment

into an individual account. The Department of Taxation is not

number. If the taxpayer did not receive a label, print or type the

responsible when a financial institution refuses a direct deposit for this

information in the space provided. Please verify that the social

reason.

security number (SSN) is clear and correct. If it is a joint or combined

Part III-Declaration of Taxpayer

return, be sure the names and SSNs are listed in the same order.

P.O. Box-If the post office does not deliver mail to the taxpayer's

The taxpayer's signature allows the Department of Taxation to advise

home and the taxpayer has a P.O. Box, enter the box number instead

the ERO or transmitter if a direct deposit election will not be honored.

of the home address.

It also allows the Department of Taxation to disclose to the ERO or

transmitter the reason(s) for a delay in processing the refund.

On-line Filed Return

-This box should only be checked if the

return is filed by the taxpayer via the internet.

If the ERO makes changes to the electronic return after form VA-

8453 has been signed by the taxpayer but before it is transmitted, the

Part I-Tax Return Information

ERO must have the taxpayer complete and sign a corrected Form

VA-8453 if either of the following applies:

Line 4.-Do not include any withholding from Form 4852, Substitute

! The total income on line 1 differs from the amount on the electronic

W-2 or withholding paid to another state.

return by more than $25, or

Part II-Direct Deposit

! The total tax on line 4 or the refund on line 6 differs from the

Taxpayers can elect to have their refund directly deposited by

amount on the electronic return by more that $7.

completing Part II.

Part IV-Declaration of Electronic Return Originator

(ERO) and Paid Preparer

Line 8.-The routing transit number (RTN) must contain nine (9) digits.

If the RTN does not begin with 01 through 12 or 21 through 32, the

direct deposit request will be rejected.

The ERO's signature is required by the Department of Taxation.

Line 9.-The depositor account number (DAN) can contain seventeen

A paid preparer must sign Form VA-8453 in the space for Paid

(17) alphanumeric characters. Include hyphens but omit spaces and

Preparers. Only handwritten signatures are acceptable. If the paid

special symbols. If fewer than seventeen (17) characters, enter the

preparer is also the ERO, do not complete the paid preparer section.

number from left to right and leave the unused boxes blank.

Instead, check the box labeled "Check if also paid preparer".

Line 10.-To be eligible for direct deposit, taxpayers must provide

Automated Refund Information-Refund information is available on

proof of account ownership to their ERO. An acceptable proof of

Tele-Tax. See the instruction booklet for Form 760 or 760S for a list

account ownership is a check, form, report, or other statement

of Tele-Tax information telephone numbers.

generated by the financial institution that has the taxpayer's name,

RTN of the financial institution, and the DAN preprinted on it.

Form VA-8453 (REV. 11-99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1