Form Sc 1040-V - Individual Income Tax Payment Voucher - 1999

ADVERTISEMENT

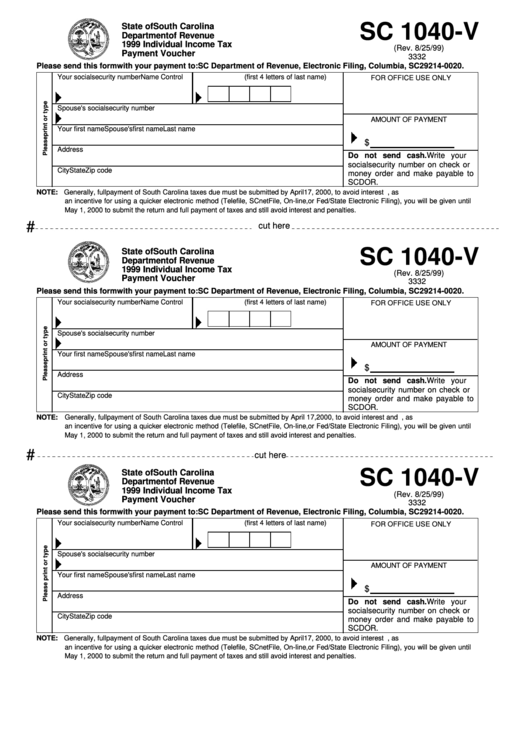

SC 1040-V

State of South Carolina

Department of Revenue

1999 Individual Income Tax

(Rev. 8/25/99)

Payment Voucher

3332

Please send this form with your payment to: SC Department of Revenue, Electronic Filing, Columbia, SC 29214-0020.

Your social security number

Name Control

(first 4 letters of last name)

FOR OFFICE USE ONLY

Spouse's social security number

AMOUNT OF PAYMENT

Your first name

Spouse's first name

Last name

$

Address

Do not send cash. Write your

social security number on check or

City

State

Zip code

money order and make payable to

SCDOR.

NOTE: Generally, full payment of South Carolina taxes due must be submitted by April 17, 2000, to avoid interest and penalties. However, as

an incentive for using a quicker electronic method (Telefile, SCnetFile, On-line, or Fed/State Electronic Filing), you will be given until

May 1, 2000 to submit the return and full payment of taxes and still avoid interest and penalties.

#

cut here

SC 1040-V

State of South Carolina

Department of Revenue

1999 Individual Income Tax

(Rev. 8/25/99)

Payment Voucher

3332

Please send this form with your payment to: SC Department of Revenue, Electronic Filing, Columbia, SC 29214-0020.

Your social security number

Name Control

(first 4 letters of last name)

FOR OFFICE USE ONLY

Spouse's social security number

AMOUNT OF PAYMENT

Your first name

Spouse's first name

Last name

$

Address

Do not send cash. Write your

social security number on check or

City

State

Zip code

money order and make payable to

SCDOR.

NOTE:

Generally, full payment of South Carolina taxes due must be submitted by April 17, 2000, to avoid interest and penalties. However, as

an incentive for using a quicker electronic method (Telefile, SCnetFile, On-line, or Fed/State Electronic Filing), you will be given until

May 1, 2000 to submit the return and full payment of taxes and still avoid interest and penalties.

#

cut here

SC 1040-V

State of South Carolina

Department of Revenue

1999 Individual Income Tax

(Rev. 8/25/99)

Payment Voucher

3332

Please send this form with your payment to: SC Department of Revenue, Electronic Filing, Columbia, SC 29214-0020.

Your social security number

Name Control

(first 4 letters of last name)

FOR OFFICE USE ONLY

Spouse's social security number

AMOUNT OF PAYMENT

Your first name

Spouse's first name

Last name

$

Address

Do not send cash. Write your

social security number on check or

City

State

Zip code

money order and make payable to

SCDOR.

NOTE: Generally, full payment of South Carolina taxes due must be submitted by April 17, 2000, to avoid interest and penalties. However, as

an incentive for using a quicker electronic method (Telefile, SCnetFile, On-line, or Fed/State Electronic Filing), you will be given until

May 1, 2000 to submit the return and full payment of taxes and still avoid interest and penalties.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1