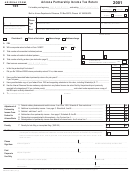

Form 165 - Arizona Partnership Income Tax Return - 1999 Page 2

ADVERTISEMENT

Form 165 (1999) Page 2

Schedule A - Additions to Partnership Income

A1 Non-Arizona municipal bond interest ................................................................................................................................................................

A1

00

A2 Capital investment by qualified defense contractor ..........................................................................................................................................

A2

00

A3 Additions related to Arizona tax credits ............................................................................................................................................................

A3

00

A4 Other additions to partnership income ..............................................................................................................................................................

A4

00

A5 Total additions to partnership income - add lines A1 through A4. Enter total here and on page 1, line 2 ........................................................

A5

00

Schedule B - Subtractions From Partnership Income

B1

B1 Interest from U.S. government obligations .......................................................................................................................................................

00

B2

B2 Difference in adjusted basis of property ...........................................................................................................................................................

00

B3 Agricultural crops charitable contribution - see instructions ..............................................................................................................................

B3

00

B4

B4 Alternative fuel vehicles and equipment - see instructions ...............................................................................................................................

00

B5

B5 Capital investment by qualified defense contractor ..........................................................................................................................................

00

B6 Other subtractions from partnership income .....................................................................................................................................................

B6

00

B7 Total subtractions from partnership income - add lines B1 through B6. Enter total here and on page 1, line 4 ...............................................

B7

00

Schedule C - Apportionment Formula (Multistate Partnerships Only)

The following information must be submitted by all partnerships having income from sources both within and without Arizona. Average lines C1(a) through C1(f).

Arizona requires a double-weighted sales factor. See instructions on pages 6 and 7 before completing this section.

(a)

(b)

(c)

Total

Total

Ratio within

within

everywhere

Arizona

Arizona

(a) / (b)

C1

Average yearly value of real and tangible personal property:

(a) Inventory ...............................................................................................................................

(b) Depreciable assets - at original cost .....................................................................................

(c) Land ......................................................................................................................................

(d) Other - describe ....................................................................................................................

(e) Less construction in progress ...............................................................................................

(f) Less nonbusiness property ...................................................................................................

(g) Net annual rent paid for leased property, multiplied by 8 .....................................................

(h) Total real and tangible personal property used ....................................................................

C2 Wages, salaries, commissions and other compensation of employees

as shown per federal Form 1065 or payroll reports ...................................................................

C3

(a) Gross sales, less returns and allowances ............................................................................

(b) Sales delivered or shipped to Arizona purchasers ...............................................................

(c) Other gross receipts (rents, royalties, interest, etc.) .............................................................

(d) Total sales within Arizona .....................................................................................................

X 2

(e) Double weight sales factor ...................................................................................................

(f ) Sales factor ratio. For column (a), multiply line C3(d) by

line C3(e); for column (b), add lines C3(a) and C3(c) ..........................................................

C4

Total ratio - add lines C1(h), C2 and C3(f), in column (c) ..........................................................

Average ratio - divide line C4, column (c) by four (4). Enter the result here

C5

and on the Arizona Schedule K-1(NR) in column (b) ................................................................

Schedule D - Business Information

Describe briefly the nature and location(s) of the partnership's Arizona business activities:

Describe briefly the nature and location(s) of the partnership's business activities outside of Arizona:

ADOR 06-0031 (99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2