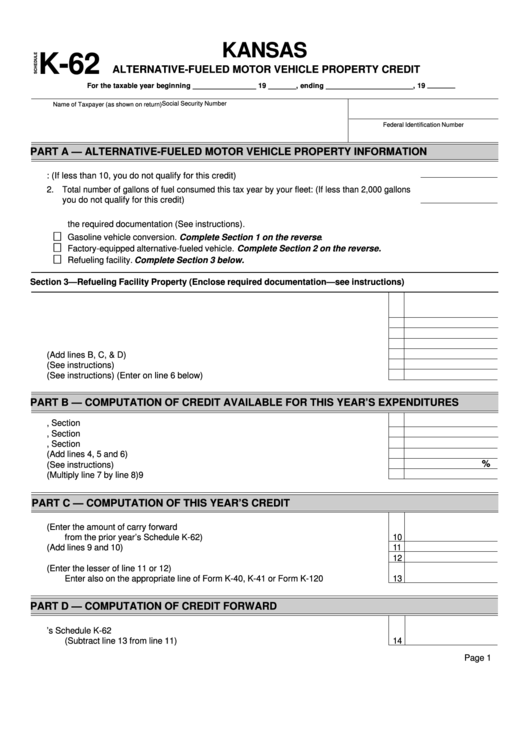

KANSAS

K-62

ALTERNATIVE-FUELED MOTOR VEHICLE PROPERTY CREDIT

For the taxable year beginning ________________ 19 _______, ending ______________________, 19 _______

Social Security Number

Name of Taxpayer (as shown on return)

Federal Identification Number

PART A — ALTERNATIVE-FUELED MOTOR VEHICLE PROPERTY INFORMATION

1. Total number of vehicles in your fleet: (If less than 10, you do not qualify for this credit) .......

2. Total number of gallons of fuel consumed this tax year by your fleet: (If less than 2,000 gallons

you do not qualify for this credit) ............................................................................................

3. Type of alternative-fueled motor vehicle property placed in service this tax year. Check all that apply and enclose

the required documentation (See instructions).

Gasoline vehicle conversion. Complete Section 1 on the reverse .

Factory-equipped alternative-fueled vehicle. Complete Section 2 on the reverse.

Refueling facility. Complete Section 3 below.

Section 3—Refueling Facility Property (Enclose required documentation—see instructions)

A. Date facility placed in service ....................................................................................

A

B. Expenditures for compression equipment .................................................................

B

C. Expenditures for storage tanks/receptacles ..............................................................

C

D. Expenditures for delivery property .............................................................................

D

E. Total qualifying property refueling station expenditures (Add lines B, C, & D) ...........

E

F. Amount of expenditures for credit (See instructions) ................................................

F

G. Amount of credit (See instructions) (Enter on line 6 below) ......................................

G

PART B — COMPUTATION OF CREDIT AVAILABLE FOR THIS YEAR’S EXPENDITURES

4. Enter amount from line 9, Section 1 ...........................................................................

4

5. Enter amount from line 9, Section 2 ...........................................................................

5

6. Enter amount from line G, Section 3 ..........................................................................

6

7. Credit available (Add lines 4, 5 and 6) .......................................................................

7

%

8. Enter your ownership percentage (See instructions) .................................................

8

9. Your share of the credit for the amount expended this year (Multiply line 7 by line 8)

9

PART C — COMPUTATION OF THIS YEAR’S CREDIT

10. Amount of carry forward available on this return (Enter the amount of carry forward

from the prior year’s Schedule K-62) ........................................................................

10

11. Total credit available (Add lines 9 and 10) ................................................................

11

12. Enter your total tax liability for this tax year after all credits other than this credit ......

12

13. Alternative fuel credit for this tax year (Enter the lesser of line 11 or 12)

Enter also on the appropriate line of Form K-40, K-41 or Form K-120 ......................

13

PART D — COMPUTATION OF CREDIT FORWARD

14. Carry forward available to next year’s Schedule K-62

(Subtract line 13 from line 11) ...................................................................................

14

Page 1

1

1 2

2