Schedule K-62 - Alternative-Fuel Tax Credit

ADVERTISEMENT

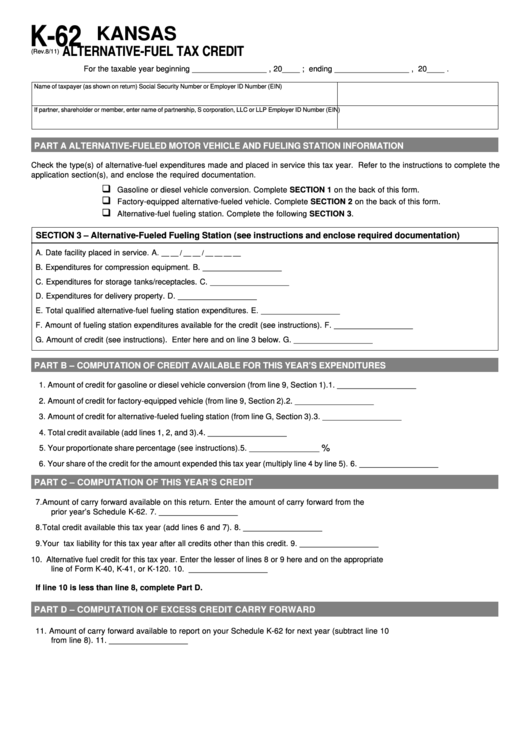

K-62

–

KANSAS

ALTERNATIVE-FUEL TAX CREDIT

(Rev.8/11)

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A

ALTERNATIVE-FUELED MOTOR VEHICLE AND FUELING STATION INFORMATION

Check the type(s) of alternative-fuel expenditures made and placed in service this tax year. Refer to the instructions to complete the

application section(s), and enclose the required documentation.

‰

Gasoline or diesel vehicle conversion. Complete SECTION 1 on the back of this form.

‰

Factory-equipped alternative-fueled vehicle. Complete SECTION 2 on the back of this form.

‰

Alternative-fuel fueling station. Complete the following SECTION 3.

SECTION 3 – Alternative-Fueled Fueling Station (see instructions and enclose required documentation)

A. Date facility placed in service.

A.

__ __ / __ __ / __ __ __ __

B. Expenditures for compression equipment.

B. __________________

C. Expenditures for storage tanks/receptacles.

C. __________________

D. Expenditures for delivery property.

D. __________________

E. Total qualified alternative-fuel fueling station expenditures.

E. __________________

F.

Amount of fueling station expenditures available for the credit (see instructions).

F.

__________________

G.

Amount of credit (see instructions). Enter here and on line 3 below.

G. __________________

PART B – COMPUTATION OF CREDIT AVAILABLE FOR THIS YEAR’S EXPENDITURES

1. Amount of credit for gasoline or diesel vehicle conversion (from line 9, Section 1).

1.

__________________

2. Amount of credit for factory-equipped vehicle (from line 9, Section 2).

2.

__________________

3. Amount of credit for alternative-fueled fueling station (from line G, Section 3).

3.

__________________

4. Total credit available (add lines 1, 2, and 3).

4.

__________________

%

5. Your proportionate share percentage (see instructions).

5.

________________

6. Your share of the credit for the amount expended this tax year (multiply line 4 by line 5).

6.

__________________

PART C – COMPUTATION OF THIS YEAR’S CREDIT

7. Amount of carry forward available on this return. Enter the amount of carry forward from the

prior year’s Schedule K-62.

7.

__________________

8. Total credit available this tax year (add lines 6 and 7).

8.

__________________

9. Your tax liability for this tax year after all credits other than this credit.

9.

__________________

10. Alternative fuel credit for this tax year. Enter the lesser of lines 8 or 9 here and on the appropriate

line of Form K-40, K-41, or K-120.

10. __________________

If line 10 is less than line 8, complete Part D.

PART D – COMPUTATION OF EXCESS CREDIT CARRY FORWARD

11. Amount of carry forward available to report on your Schedule K-62 for next year (subtract line 10

from line 8).

11. __________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4