Form 1040me - Schedule A - Adjustments To Tax - 1999

ADVERTISEMENT

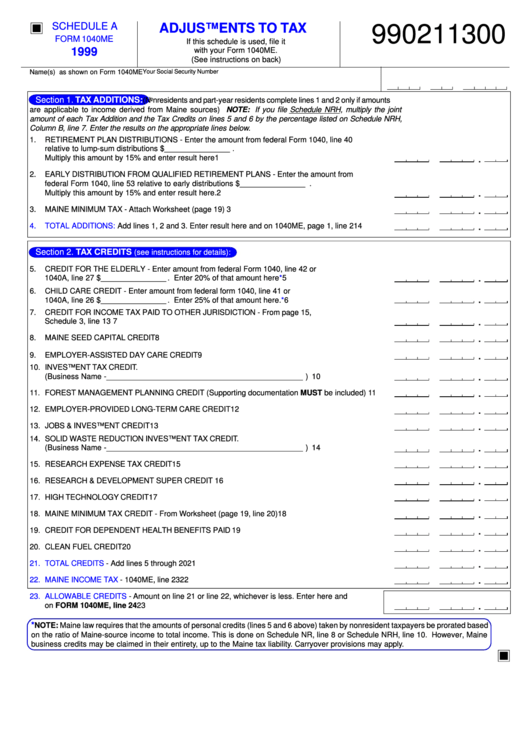

SCHEDULE A

ADJUSTMENTS TO TAX

990211300

FORM 1040ME

If this schedule is used, file it

1999

with your Form 1040ME.

(See instructions on back)

Name(s) as shown on Form 1040ME

Your Social Security Number

Section 1. TAX ADDITIONS:

(Nonresidents and part-year residents complete lines 1 and 2 only if amounts

are applicable to income derived from Maine sources) NOTE: If you file Schedule NRH, multiply the joint

amount of each Tax Addition and the Tax Credits on lines 5 and 6 by the percentage listed on Schedule NRH,

Column B, line 7. Enter the results on the appropriate lines below.

1.

RETIREMENT PLAN DISTRIBUTIONS - Enter the amount from federal Form 1040, line 40

relative to lump-sum distributions $ _______________ .

Multiply this amount by 15% and enter result here ............................................................................. 1

.

2.

EARLY DISTRIBUTION FROM QUALIFIED RETIREMENT PLANS - Enter the amount from

federal Form 1040, line 53 relative to early distributions $ _______________ .

Multiply this amount by 15% and enter result here. ............................................................................ 2

.

3.

MAINE MINIMUM TAX - Attach Worksheet (page 19) ........................................................................ 3

.

4.

TOTAL ADDITIONS:

Add lines 1, 2 and 3. Enter result here and on 1040ME, page 1, line 21 ............ 4

.

Section 2. TAX CREDITS

(see instructions for details):

5.

CREDIT FOR THE ELDERLY - Enter amount from federal Form 1040, line 42 or

1040A, line 27 $ _______________ . Enter 20% of that amount here ............................................... *5

.

6.

CHILD CARE CREDIT - Enter amount from federal form 1040, line 41 or

.

1040A, line 26 $ _______________ . Enter 25% of that amount here. .............................................. *6

7.

CREDIT FOR INCOME TAX PAID TO OTHER JURISDICTION - From page 15,

Schedule 3, line 13 ............................................................................................................................ 7

.

8.

MAINE SEED CAPITAL CREDIT ....................................................................................................... 8

.

9.

EMPLOYER-ASSISTED DAY CARE CREDIT .................................................................................... 9

.

10. INVESTMENT TAX CREDIT.

(Business Name - _____________________________________________ ) ................................. 10

.

11. FOREST MANAGEMENT PLANNING CREDIT (Supporting documentation MUST be included) ....... 11

.

12. EMPLOYER-PROVIDED LONG-TERM CARE CREDIT ..................................................................... 12

.

13. JOBS & INVESTMENT CREDIT ........................................................................................................ 13

.

14. SOLID WASTE REDUCTION INVESTMENT TAX CREDIT.

(Business Name - _____________________________________________ ) ................................. 14

.

15. RESEARCH EXPENSE TAX CREDIT ................................................................................................ 15

.

16. RESEARCH & DEVELOPMENT SUPER CREDIT ............................................................................. 16

.

17. HIGH TECHNOLOGY CREDIT .......................................................................................................... 17

.

18. MAINE MINIMUM TAX CREDIT - From Worksheet (page 19, line 20) ................................................ 18

.

19. CREDIT FOR DEPENDENT HEALTH BENEFITS PAID ..................................................................... 19

.

20. CLEAN FUEL CREDIT ....................................................................................................................... 20

.

21. TOTAL CREDITS

- Add lines 5 through 20 ......................................................................................... 21

.

22. MAINE INCOME TAX

- 1040ME, line 23 ............................................................................................ 22

.

23. ALLOWABLE CREDITS

- Amount on line 21 or line 22, whichever is less. Enter here and

on FORM 1040ME, line 24 ................................................................................................................ 23

.

*

NOTE: Maine law requires that the amounts of personal credits (lines 5 and 6 above) taken by nonresident taxpayers be prorated based

on the ratio of Maine-source income to total income. This is done on Schedule NR, line 8 or Schedule NRH, line 10. However, Maine

business credits may be claimed in their entirety, up to the Maine tax liability. Carryover provisions may apply.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2