Form 1041me - Schedule A - Adjustments To Tax - 2006

ADVERTISEMENT

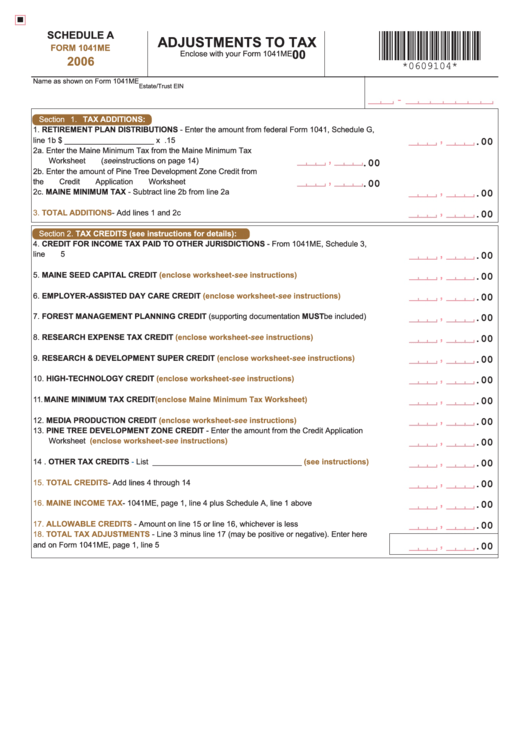

SCHEDULE A

ADJUSTMENTS TO TAX

FORM 1041ME

00

Enclose with your Form 1041ME

2006

*0609104*

Name as shown on Form 1041ME

Estate/Trust EIN

-

Section 1. TAX ADDITIONS:

1.

RETIREMENT PLAN DISTRIBUTIONS - Enter the amount from federal Form 1041, Schedule G,

,

line 1b $ _____________________ x .15 ............................................................................................1

.00

2a. Enter the Maine Minimum Tax from the Maine Minimum Tax

,

Worksheet (see instructions on page 14) ........................................... 2a

.00

2b. Enter the amount of Pine Tree Development Zone Credit from

,

the Credit Application Worksheet ....................................................... 2b

.00

,

2c. MAINE MINIMUM TAX - Subtract line 2b from line 2a .........................................................................2c

.00

,

3.

TOTAL ADDITIONS

- Add lines 1 and 2c .............................................................................................3

.00

Section 2. TAX CREDITS (see instructions for details):

4.

CREDIT FOR INCOME TAX PAID TO OTHER JURISDICTIONS - From 1041ME, Schedule 3,

,

line 5 .......................................................................................................................................................4

.00

,

5.

MAINE SEED CAPITAL CREDIT

(enclose worksheet-see instructions)

.........................................5

.00

,

6.

EMPLOYER-ASSISTED DAY CARE CREDIT

(enclose worksheet-see instructions)

.....................6

.00

,

7.

FOREST MANAGEMENT PLANNING CREDIT (supporting documentation MUST be included) ........7

.00

,

8.

RESEARCH EXPENSE TAX CREDIT

(enclose worksheet-see instructions)

.................................8

.00

,

9.

RESEARCH & DEVELOPMENT SUPER CREDIT

(enclose worksheet-see instructions)

..............9

.00

,

10. HIGH-TECHNOLOGY CREDIT

(enclose worksheet-see instructions)

..........................................10

.00

,

11. MAINE MINIMUM TAX CREDIT

(enclose Maine Minimum Tax Worksheet)

................................. 11

.00

,

12. MEDIA PRODUCTION CREDIT

(enclose worksheet-see instructions)

.........................................12

.00

13. PINE TREE DEVELOPMENT ZONE CREDIT - Enter the amount from the Credit Application

,

Worksheet

(enclose worksheet-see instructions)

..........................................................................13

.00

,

14 . OTHER TAX CREDITS

-

List ___________________________________

(see instructions)

....14

.00

,

15. TOTAL CREDITS

- Add lines 4 through 14 ..........................................................................................15

.00

,

16. MAINE INCOME TAX

- 1041ME, page 1, line 4 plus Schedule A, line 1 above ..................................16

.00

,

17. ALLOWABLE CREDITS

- Amount on line 15 or line 16, whichever is less .......................................17

.00

18. TOTAL TAX ADJUSTMENTS

- Line 3 minus line 17 (may be positive or negative). Enter here

,

and on Form 1041ME, page 1, line 5 ...................................................................................................18

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1