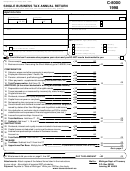

Form C-8000x - Single Business Tax Amended Return Page 2

ADVERTISEMENT

Federal Employer Identification Number

As Reported

Correct

TAX BASE

or Adjusted

Amount

34

.00

.00

What amount did you enter on line 32 or 33 (whichever applies)?

34

34

ADJUSTMENTS

35

.00

.00

Capital acquisition deduction (from C-8000D)

35

35

36

.00

.00

Recapture of capital acquisition deduction (from C-8000D)

36

36

37

.00

.00

Net capital acquisition deduction. Subtract line 36 from line 35

37

37

38

Adjusted tax base before loss deduction and statutory exemption

.00

.00

Subtract (if negative add) line 37 from 34. If negative, loss carryforward

38

38

39

.00

.00

Business loss deduction

39

39

40

.00

.00

Adjusted tax base before statutory exemption. Subtract line 39 from 38

40

40

STATUTORY EXEMPTION (See schedule C-8043 in the instruction booklet.)

41

.00

.00

Allowable statutory exemption from schedule (attach C-8043)

41

41

42

ADJUSTED TAX BASE. Subtract line 41 from line 40.

.00

.00

42

42

Check if C-8000G is attached.

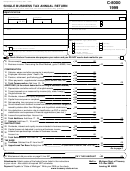

REDUCTIONS, CREDITS, TAX

43

.00

.00

Reduction to adjusted tax base, if applicable (see form C-8000S)

43

43

44

.00

.00

Taxable base. Subtract line 43 from 42 or enter amount from C-8000S

44

44

45

.00

.00

TAX BEFORE CREDITS. Multiply line 44 by the applicable tax rate

45

45

Amend the small business and contribution credits on form C-8000C before continuing.

If you did not claim these credits enter the amount from line 45 on line 46.

46

.00

.00

Enter either the amount from form C-8000, line 45 or C-8000C

46

46

47

.00

.00

Unincorporated/S-Corp Credit

47

47

48

.00

.00

Nonrefundable Credits

48

48

49

.00

.00

Add lines 47 and 48

49

49

50

.00

.00

Tax After Nonrefundable Credits. Subtract line 49 from line 46

50

50

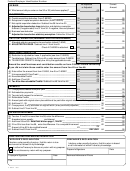

PAYMENTS

51

.00

.00

Overpayment credited from prior year

51

51

52

.00

.00

Estimated tax payments

52

52

53

.00

.00

Tax paid with request for extension

53

53

54

.00

.00

Refundable Credits

54

54

55

.00

Amount paid with original return plus additional tax paid after original return was filed

55

56

.00

Add lines 51 - 55

56

57

.00

Overpayment, if any, as shown on original return (or as previously adjusted)

57

58

.00

Subtract line 57 from line 56

58

TAX DUE/OVERPAYMENT

59

.00

Tax due. If line 50 is more than line 58, enter the difference

59

60

.00

Amended return penalty _________ and interest _________

60

61

.00

Add lines 59 and 60. Enter here and on page 1, line 65

61

62

.00

If line 50 is less than line 58, enter the difference. You overpaid this amount

62

63

.00

Amount of line 62 to be credited forward

63

64

.00

Subtract line 63 from line 62

64

REFUND

SIGNATURE AND PREPARER AUTHORIZATION

TAXPAYER'S DECLARATION

PREPARER'S DECLARATION

I declare, under penalty of perjury, that this return is true

I declare, under penalty of perjury, that this return is based

and correct to the best of my knowledge.

on all information of which I have any knowledge.

I authorize Treasury to discuss my return with my preparer.

Preparer's Signature

Date

Do not discuss my return with my preparer.

Taxpayer's Signature

Date

Business Address and Phone

Title

C-8000X 1999

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2