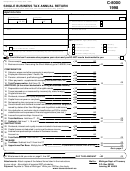

Form C-8000 - Single Business Tax Annual Return - 1999

ADVERTISEMENT

C-8000

Michigan Dept. of Treasury (Rev. 10-99)

SINGLE BUSINESS TAX ANNUAL RETURN

1999

Issued under authority of P.A. 228 of 1975. See instruction booklet for filing guidelines.

IDENTIFICATION

1

5

This return is for calendar year 1999 or for the following tax year

Federal Employer ID No. (FEIN) or TR No.

Beginning Date

Ending Date

month

year

month

year

1999

6a

Check this box if address is new

Name (Type or Print)

b

2

Check this box if discontinued

Effective date of discontinuance

d/b/a

7

Business Start Date

Street Address

8

Principal Business Activity

City, State, ZIP

9

Organization Type (check one)

a.

b.

Individual

Fiduciary

3

Check this box if you are filing a Michigan consolidated return.

c.

d.

Professional Corporation

S-Corporation

Enter authorization number

e.

f.

Other Corporation

Partnership/LLC-Partnership

4

Check this box if you are a member of a controlled group (see instruction book).

g.

Limited Liability

Company-Corporation

Check this box if someone else prepares your return and you DO NOT need a book mailed to you.

.00

Gross receipts

10

10

.00

Business income. Filers using the Short-Method, go to C-8000S, line 9

11

11

COMPENSATION

.00

Salaries, wages and other payments to employees

12

12

.00

Employee insurance plans - health, life

13

13

.00

Pension, retirement, profit sharing plans

14

14

.00

Other payments - supplemental unemployment benefit trust, etc

15

15

.00

Total Compensation. Add lines 12 - 15

16

16

ADDITIONS (to the extent deducted in arriving at business income)

.00

Depreciation and other write-off of tangible assets

17

17

.00

Taxes imposed on or measured by income (city, state, foreign)

18

18

.00

Single business tax

19

19

.00

Dividends, interest and royalty expenses

20

20

.00

Capital loss carryover or carryback

21

21

.00

Net operating loss carryover or carryback

22

22

Gross interest and dividend income from bonds and similar obligations

23

.00

issued by states other than Michigan and its political subdivisions

23

Any deduction or exclusion due to classification as FSC or similar

24

.00

classification and expenses of financial organizations (see inst.)

24

.00

Losses from partnerships. Account no.

25

25

.00

Total Additions. Add lines 17 - 25

26

26

.00

Subtotal. Add lines 11, 16 and 26

27

27

SUBTRACTIONS

.00

Dividends, interest and royalty income included in business income

28

28

.00

Capital losses not deducted in arriving at business income

29

29

Income from partnerships included in business income,

30

.00

Account no.

30

.00

Total Subtractions. Add lines 28 - 30

31

31

TAX BASE

.00

Tax Base. Subtract line 31 from line 27

32

32

.00

Apportioned Tax Base. Multiply line 32 by ____________ % (from form C-8000H, line 16 or 19)

33

33

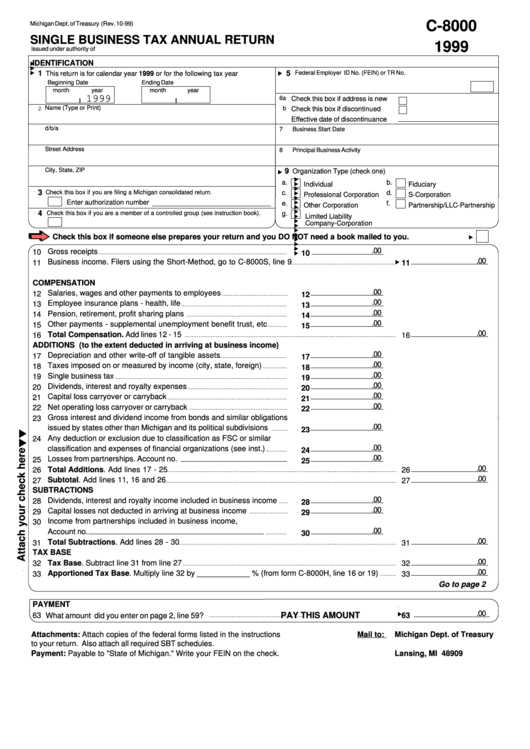

Go to page 2

PAYMENT

.00

PAY THIS AMOUNT

63

What amount did you enter on page 2, line 59?

63

Attachments: Attach copies of the federal forms listed in the instructions

Mail to:

Michigan Dept. of Treasury

to your return. Also attach all required SBT schedules.

P.O. Box 30059

Payment: Payable to "State of Michigan." Write your FEIN on the check.

Lansing, MI 48909

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2