Form S1040ez - Income Tax Return - 2000

ADVERTISEMENT

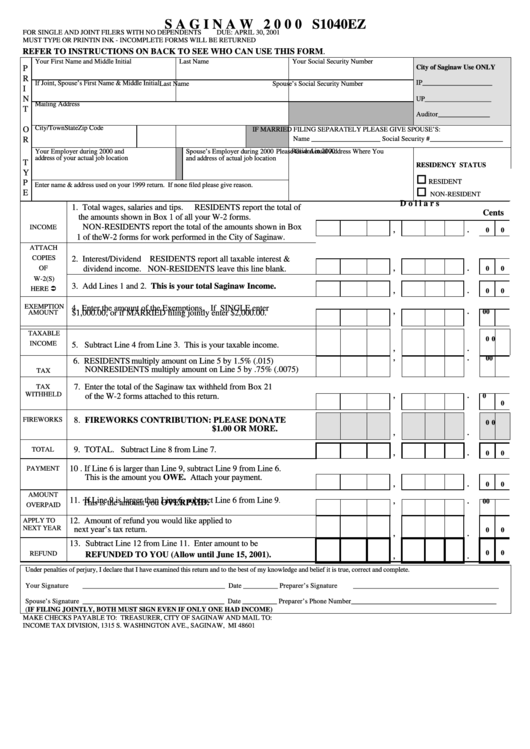

S A G I N A W 2 0 0 0 S1040EZ

FOR SINGLE AND JOINT FILERS WITH NO DEPENDENTS

DUE: APRIL 30, 2001

MUST TYPE OR PRINT IN INK - INCOMPLETE FORMS WILL BE RETURNED

REFER TO INSTRUCTIONS ON BACK TO SEE WHO CAN USE THIS FORM.

Your First Name and Middle Initial

Last Name

Your Social Security Number

City of Saginaw Use ONLY

P

R

IP____________________

If Joint, Spouse’s First Name & Middle Initial

Last Name

Spouse’s Social Security Number

I

N

UP___________________

T

Mailing Address

Auditor_______________

O

City/Town

State

Zip Code

IF MARRIED FILING SEPARATELY PLEASE GIVE SPOUSE’S:

R

Name ____________________ Social Security #_____________________

Your Employer during 2000 and

Spouse’s Employer during 2000

Please Give Actual Address Where You

address of your actual job location

and address of actual job location

Resided in 2000

T

RESIDENCY STATUS

Y

o

RESIDENT

P

Enter name & address used on your 1999 return. If none filed please give reason.

o

E

NON-RESIDENT

1. Total wages, salaries and tips.

RESIDENTS report the total of

D o l l a r s

Cents

the amounts shown in Box 1 of all your W-2 forms.

NON-RESIDENTS report the total of the amounts shown in Box

INCOME

,

.

0

0

1 of theW-2 forms for work performed in the City of Saginaw.

ATTACH

COPIES

2. Interest/Dividend RESIDENTS report all taxable interest &

OF

dividend income. NON-RESIDENTS leave this line blank.

,

.

0

0

W-2(S)

3. Add Lines 1 and 2. This is your total Saginaw Income.

HERE Ü

,

.

0

0

EXEMPTION

4. Enter the amount of the Exemptions. If SINGLE enter

AMOUNT

$1,000.00; or if MARRIED filing jointly enter $2,000.00.

,

.

0

0

TAXABLE

0

0

INCOME

5. Subtract Line 4 from Line 3. This is your taxable income.

,

.

6. RESIDENTS multiply amount on Line 5 by 1.5% (.015)

,

.

0

0

NONRESIDENTS multiply amount on Line 5 by .75% (.0075)

TAX

TAX

7. Enter the total of the Saginaw tax withheld from Box 21

WITHHELD

of the W-2 forms attached to this return.

,

.

0

0

8. FIREWORKS CONTRIBUTION: PLEASE DONATE

FIREWORKS

0

0

$1.00 OR MORE.

,

.

TOTAL

9. TOTAL. Subtract Line 8 from Line 7.

,

.

0

0

PAYMENT

10 . If Line 6 is larger than Line 9, subtract Line 9 from Line 6.

This is the amount you OWE. Attach your payment.

,

.

0

0

AMOUNT

11. If Line 9 is larger than Line 6, subtract Line 6 from Line 9

.

OVERPAID

This is the amount you OVERPAID.

,

.

0

0

12. Amount of refund you would like applied to

APPLY TO

NEXT YEAR

next year’s tax return.

0

0

,

.

13. Subtract Line 12 from Line 11. Enter amount to be

0

0

REFUND

REFUNDED TO YOU (Allow until June 15, 2001).

,

.

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief it is true, correct and complete.

Your Signature

_________________________________________ Date __________ Preparer’s Signature

__________________________________________

Spouse’s Signature _________________________________________ Date __________ Preparer’s Phone Number__________________________________________

(IF FILING JOINTLY, BOTH MUST SIGN EVEN IF ONLY ONE HAD INCOME)

MAKE CHECKS PAYABLE TO: TREASURER, CITY OF SAGINAW AND MAIL TO:

INCOME TAX DIVISION, 1315 S. WASHINGTON AVE., SAGINAW, MI 48601

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1