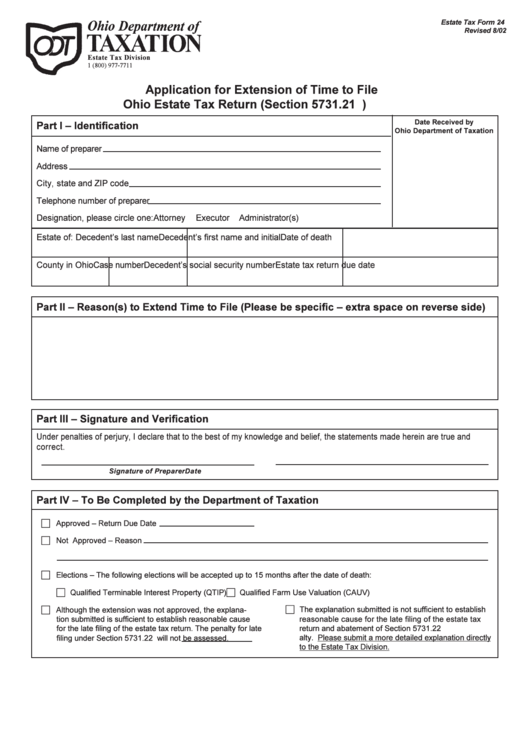

Form 24 - Application For Extension Of Time To File Ohio Estate Tax Return

ADVERTISEMENT

Estate Tax Form 24

Revised 8/02

Estate Tax Division

1 (800) 977-7711

Application for Extension of Time to File

Ohio Estate Tax Return (Section 5731.21 O.R.C.)

Date Received by

Part I – Identification

Ohio Department of Taxation

Name of preparer

Address

City, state and ZIP code

Telephone number of preparer

Designation, please circle one:

Attorney

Executor

Administrator(s)

Estate of: Decedent’s last name

Decedent’s first name and initial

Date of death

County in Ohio

Case number

Decedent’s social security number

Estate tax return due date

Part II – Reason(s) to Extend Time to File (Please be specific – extra space on reverse side)

Part III – Signature and Verification

Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements made herein are true and

correct.

Signature of Preparer

Date

Part IV – To Be Completed by the Department of Taxation

c

Approved – Return Due Date

c

Not Approved – Reason

c

Elections – The following elections will be accepted up to 15 months after the date of death:

c

c

Qualified Terminable Interest Property (QTIP)

Qualified Farm Use Valuation (CAUV)

c

c

Although the extension was not approved, the explana-

The explanation submitted is not sufficient to establish

reasonable cause for the late filing of the estate tax

tion submitted is sufficient to establish reasonable cause

for the late filing of the estate tax return. The penalty for late

return and abatement of Section 5731.22 O.R.C. pen-

filing under Section 5731.22 O.R.C. will not be assessed.

alty. Please submit a more detailed explanation directly

to the Estate Tax Division.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1