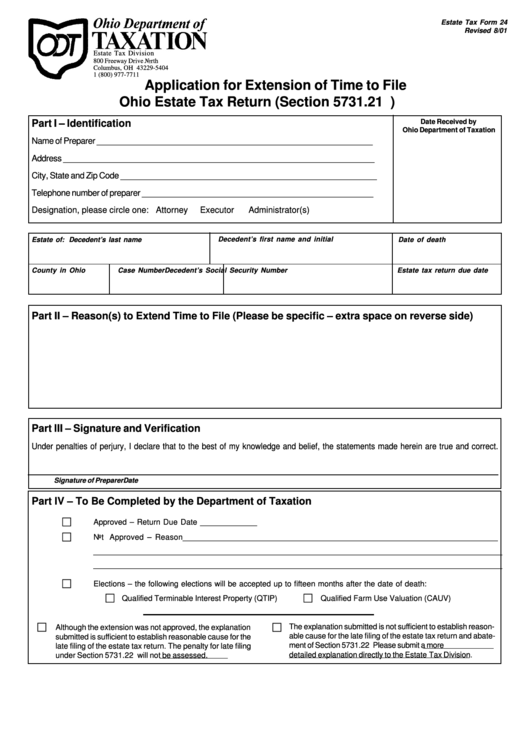

Estate Tax Form 24 - Application For Extension Of Time To File Ohio Estate Tax Return

ADVERTISEMENT

Estate Tax Form 24

Revised 8/01

Estate Tax Division

800 Freeway Drive North

Columbus, OH 43229-5404

1 (800) 977-7711

Application for Extension of Time to File

Ohio Estate Tax Return (Section 5731.21 O.R.C.)

Part I – Identification

Date Received by

Ohio Department of Taxation

Name of Preparer _____________________________________________________________

Address _____________________________________________________________________

City, State and Zip Code ________________________________________________________

Telephone number of preparer ___________________________________________________

Designation, please circle one: Attorney

Executor

Administrator(s)

Decedent’s first name and initial

Estate of: Decedent’s last name

Date of death

County in Ohio

Case Number

Decedent’s Social Security Number

Estate tax return due date

Part II – Reason(s) to Extend Time to File (Please be specific – extra space on reverse side)

Part III – Signature and Verification

Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements made herein are true and correct.

Signature of Preparer

Date

Part IV – To Be Completed by the Department of Taxation

c

Approved – Return Due Date _____________

c

Not Approved – Reason______________________________________________________________________

_________________________________________________________________________________________

_________________________________________________________________________________________

c

Elections – the following elections will be accepted up to fifteen months after the date of death:

c

c

Qualified Terminable Interest Property (QTIP)

Qualified Farm Use Valuation (CAUV)

c

c

The explanation submitted is not sufficient to establish reason-

Although the extension was not approved, the explanation

able cause for the late filing of the estate tax return and abate-

submitted is sufficient to establish reasonable cause for the

ment of Section 5731.22 O.R.C. penalty. Please submit a more

late filing of the estate tax return. The penalty for late filing

detailed explanation directly to the Estate Tax Division.

under Section 5731.22 O.R.C. will not be assessed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1