Montana Form Telc - Temporary Emergency Lodging Credit - 2012

ADVERTISEMENT

1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

MONTANA

4

4

TELC

5

5

Rev 02 12

6

6

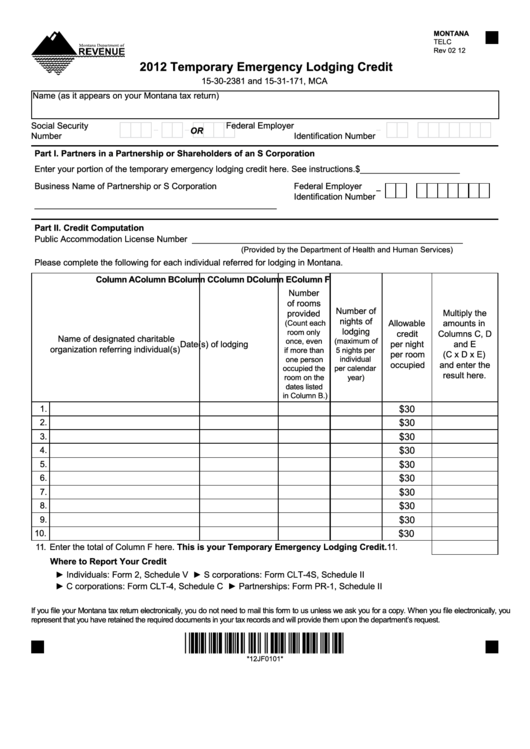

2012 Temporary Emergency Lodging Credit

7

7

8

8

15-30-2381 and 15-31-171, MCA

9

9

Name (as it appears on your Montana tax return)

10

10

11

11

12

12

Social Security

Federal Employer

-

-

-

X X X X X X X X X

X X X X X X X X X

13

13

OR

Number

Identification Number

14

14

15

15

Part I. Partners in a Partnership or Shareholders of an S Corporation

16

16

Enter your portion of the temporary emergency lodging credit here. See instructions.

$_____________________

17

17

18

18

Business Name of Partnership or S Corporation

Federal Employer

-

19

19

Identification Number

20

20

___________________________________________________

21

21

22

22

Part II. Credit Computation

23

23

Public Accommodation License Number _________________________________________________________

24

24

(Provided by the Department of Health and Human Services)

25

25

Please complete the following for each individual referred for lodging in Montana.

26

26

27

27

Column A

Column B

Column C

Column D

Column E

Column F

28

28

Number

29

29

of rooms

30

30

Number of

Multiply the

provided

31

31

nights of

Allowable

amounts in

(Count each

32

32

lodging

room only

credit

Columns C, D

33

33

Name of designated charitable

(maximum of

once, even

Date(s) of lodging

per night

and E

34

34

organization referring individual(s)

if more than

5 nights per

per room

(C x D x E)

35

35

one person

individual

occupied

and enter the

36

occupied the

per calendar

36

result here.

year)

room on the

37

37

dates listed

38

38

in Column B.)

39

39

1.

$30

40

40

41

41

2.

$30

42

42

3.

$30

43

43

$30

4.

44

44

45

45

$30

5.

46

46

$30

6.

47

47

7.

$30

48

48

49

49

8.

$30

50

50

9.

$30

51

51

10.

$30

52

52

53

53

11. Enter the total of Column F here. This is your Temporary Emergency Lodging Credit. ..........11.

54

54

Where to Report Your Credit

55

55

► Individuals: Form 2, Schedule V

► S corporations: Form CLT-4S, Schedule II

56

56

► C corporations: Form CLT-4, Schedule C

► Partnerships: Form PR-1, Schedule II

57

57

58

58

59

59

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

60

60

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

61

61

62

*12JF0101*

62

63

63

64

64

*12JF0101*

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

8485

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2