Clear Form

MONTANA

TELC

Rev. 08 10

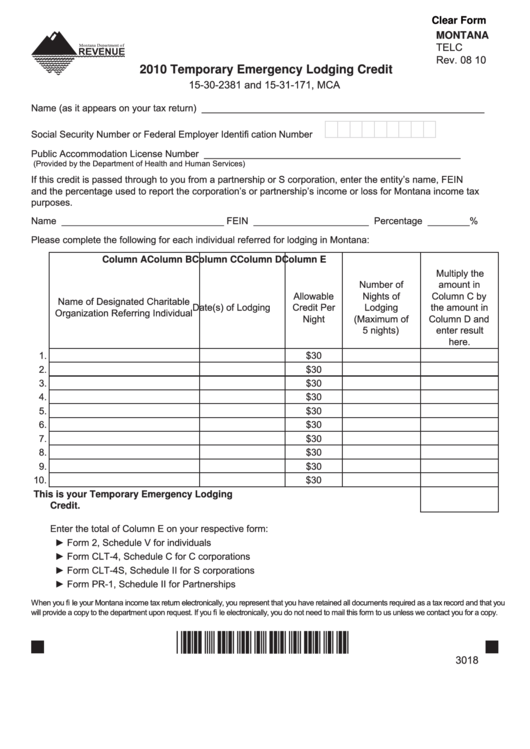

2010 Temporary Emergency Lodging Credit

15-30-2381 and 15-31-171, MCA

Name (as it appears on your tax return) ______________________________________________________

Social Security Number or Federal Employer Identifi cation Number

Public Accommodation License Number _________________________________________________

(Provided by the Department of Health and Human Services)

If this credit is passed through to you from a partnership or S corporation, enter the entity’s name, FEIN

and the percentage used to report the corporation’s or partnership’s income or loss for Montana income tax

purposes.

Name _______________________________ FEIN ______________________ Percentage ________ %

Please complete the following for each individual referred for lodging in Montana:

Column A

Column B

Column C

Column D

Column E

Multiply the

Number of

amount in

Allowable

Nights of

Column C by

Name of Designated Charitable

Date(s) of Lodging

Credit Per

Lodging

the amount in

Organization Referring Individual

Night

(Maximum of

Column D and

5 nights)

enter result

here.

1.

$30

2.

$30

3.

$30

4.

$30

5.

$30

6.

$30

7.

$30

8.

$30

9.

$30

10.

$30

11. Enter the total of Column E here. This is your Temporary Emergency Lodging

Credit. .......................................................................................................................... 11.

Enter the total of Column E on your respective form:

► Form 2, Schedule V for individuals

► Form CLT-4, Schedule C for C corporations

► Form CLT-4S, Schedule II for S corporations

► Form PR-1, Schedule II for Partnerships

When you fi le your Montana income tax return electronically, you represent that you have retained all documents required as a tax record and that you

will provide a copy to the department upon request. If you fi le electronically, you do not need to mail this form to us unless we contact you for a copy.

*30180101*

3018

1

1