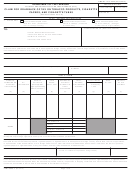

PART III - CUSTOMS OFFICER'S CERTIFICATION OF LADING OR DEPOSIT

I HEREBY CERTIFY THAT THE BEER DESCRIBED IN PART I WAS FOUND TO BE AS DESCRIBED, EXCEPT AS NOTED IN ITEM 19, AND THAT THE BEER WAS --

16. LADEN FOR

AIRCRAFT (Name, symbols, number)

VESSEL (Name)

USE AS

EXPORT

TRUCK (State license)

SUPPLIES

RAILROAD CAR (Number)

ON BOARD

17. RECEIVED IN

SERIAL NUMBER OF SEALS USED

(Number)

18. SHIPPED TO (Frontier port)

FOREIGN-TRADE ZONE

19. INSPECTION DISCLOSED

DISCREPANCIES OR SHORT

NO DISCREPANCY

NO EVIDENCE OF TAMPERING

SHIPMENT AS FOLLOWS:

20. DATE

21. PORT

22. SIGNATURE AND TITLE OF CUSTOMS OFFICER

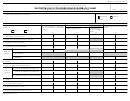

PART IV - CUSTOMS OFFICER'S REPORT OF THROUGH SHIPMENT AT FRONTIER PORT

25. INSPECTION DISCLOSED

23. FRONTIER PORT

24. DATE REC'D

NO EVIDENCE

SEALS BROKEN

SEALS INTACT

(See item 26)

OF TAMPERING

26. NATURE AND EXTENT OF DISCREPANCIES, TRANSSHIPMENT, RESEALING, ETC.

FOREIGN PORT

27. THE EXPORTING CONVEYANCE IDENTIFIED IN ITEM 16, BEARING THE BEER

DESCRIBED IN ITEM 9, WITH EXCEPTIONS AS NOTED IN ITEMS 19 AND 26,

CLEARED FROM THIS PORT FOR THE PORT OF

28. DATE

29. SIGNATURE AND TITLE OF CUSTOMS OFFICER

PART V - CERTIFICATE OF CLEARANCE OR USE

30. THE EXPORTING CONVEYANCE BEARING THE BEER DESCRIBED IN ITEM 9, WITH EXCEPTIONS AS NOTED ABOVE --

CLEARED FROM THE PORT OF

ON (Date)

BOUND FOR (Foreign port)

33. SIGNATURE OF DIRECTOR OF CUSTOMS

32. DATE

31. THE BEER HAS BEEN USED AS SUPPLIES ON THE

FISHING VESSEL IDENTIFIED ABOVE, AND THE

EVIDENCE OF SUCH USE HAS BEEN RECEIVED

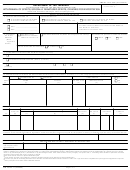

PART VI - CERTIFICATE OF RECEIPT BY ARMED FORCES OFFICER

The beer described in Part I, with exceptions as noted in item 35, was received for export to the Armed Forces of the United States. The beer will not be

shipped for consumption or use in any place subject to application of the Internal Revenue laws of the United States.

34. DATE

35. DISCREPANCY

36. SIGNATURE

37. RANK

38. TITLE

INSTRUCTIONS

1. GENERAL. Prepare a separate TTB F 5130.6, in quadruplicate, for the products

must execute Part V, forward the original to the Director, National Revenue Center,

of each brewer. Under 27 CFR 28.226 an agent is a person who has on file with

Alcohol and Tobacco Tax and Trade Bureau at the address shown in item 4, and retain

the Director, National Revenue Center, Alcohol and Tobacco Tax and Trade Bureau, a

the copy for his\her files.

TTB F 5000.8, Power of Attorney, authorizing him/her to act on behalf of the principal.

(d) Lading at Interior Port For Exportation Through Frontier Port. On

2. SHIPMENT BY BREWER OR BREWER'S AGENT. Complete Parts I and II,

completion of lading, the Customs Officer must affix the customs seals, then execute

forward the original and one copy to the official designated in item 6, forward one

Part III on both copies and forward them to the Director of Customs at the interior port of

copy to the Director, National Revenue Center, Alcohol and Tobacco Tax and Trade

lading for forwarding to the Customs Officer at the frontier port. (Exception, if the

Bureau at the address shown in item 4, and retain the remaining copy for filing.

shipment is by truck and if instructions from the Director of Customs so provide, the

copies may be forwarded via the truck driver to the Customs Officer at the frontier

3. ACTION BY CUSTOMS.

port.) That officer, when satisfied that the shipment has been exported, must execute

(a) Shipment for Direct Exportation. After inspection of lading, the Customs

Part IV on both copies and return them to the Director of Customs at the interior port.

Officer must execute Part III on both copies and forward them to the Director of

The Director of Customs must then execute Part V, forward the original to the

Customs. On clearance at the conveyance, the Director of Customs must execute

Director, National Revenue Center, Alcohol and Tobacco Tax and Trade Bureau at the

Part V, forward the original to the Director, National Revenue Center, Alcohol and

address shown in item 4, and retain the copy for his/her files.

Tobacco Tax and Trade Bureau at the address shown in item 4, and retain the

copy for his/her files.

(e) Receipt in Foreign-Trade Zone. On receipt of the beer, the Customs

Officer must complete Part III on both copies, forward the original to the Director,

(b) Supplies on Aircraft and Vessels Other Than Fishing Vessels.

National Revenue Center, Alcohol and Tobacco Tax and Trade Bureau at the address

After inspection of lading, the Customs Officer must execute Part III on both copies,

shown in item 4, and retain the copy for his/ her files.

forward the original to the Director, National Revenue Center, Alcohol and Tobacco Tax

and Trade Bureau at the address shown in item 4, and retain the copy for his/her files.

4. ACTION BY ARMED FORCES OFFICER. On receipt of the beer, the officer to

whom consigned (or other authorized supply officer) must execute Part VI on both

(c) Supplies on Fishing Vessels. After inspection of lading, the Customs

copies, forward the original to the Director, National Revenue Center, Alcohol and

Officer must execute Part III on both copies and forward them to the Director of

Tobacco Tax and Trade Bureau at the address shown in item 4,and retain the copy for

Customs. The Director of Customs (on receipt of the required Customers Form 5125)

his/ her records.

PAPERWORK REDUCTION ACT NOTICE

This request is in accordance with the Paperwork Reduction Act of 1995. The information collection is used to obtain drawback of Federal taxes on beer exported from the United States.

This information is required to obtain a benefit by 26 U.S.C. 5055.

The estimated average burden associated with this collection of information is 1 hour per respondent or recordkeeper, depending on individual circumstances. Comments concerning the

accuracy of this burden estimate and suggestions for reducing this burden, should be addressed to the Reports Management Officer, Regulations and Rulings Division, Alcohol and Tobacco

Tax and Trade Bureau, 1310 G Street, NW, Ste. 200-E, Washington, D.C. 20220.

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a current, valid OMB control number.

TTB F 5130.6 (10/2008)

Page 2 of 2

1

1 2

2