Form Cit-4 - New Mexico Preservation Of Cultural Properties Credit

ADVERTISEMENT

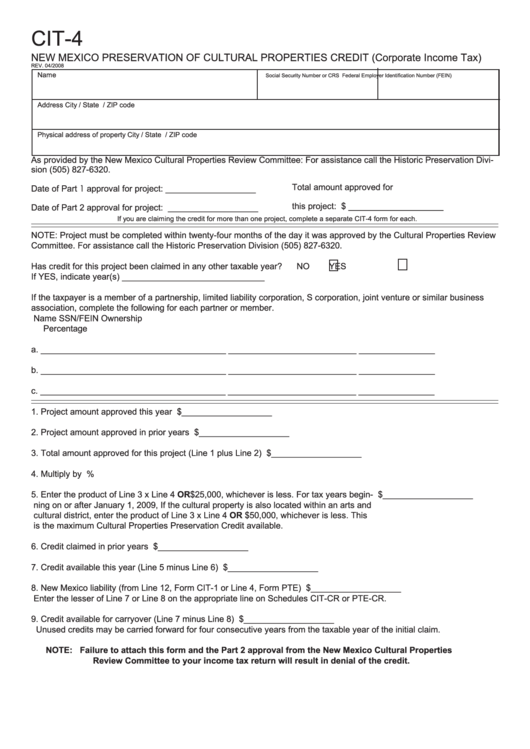

CIT-4

NEW MEXICO PRESERVATION OF CULTURAL PROPERTIES CREDIT (Corporate Income Tax)

REV. 04/2008

Name

Social Security Number or CRS I.D. Number

Federal Employer Identification Number (FEIN)

Address

City / State / ZIP code

Physical address of property

City / State / ZIP code

As provided by the New Mexico Cultural Properties Review Committee: For assistance call the Historic Preservation Divi-

sion (505) 827-6320.

Total amount approved for

Date of Part 1 approval for project: ___________________

this project: $ ____________________

Date of Part 2 approval for project: ___________________

If you are claiming the credit for more than one project, complete a separate CIT-4 form for each.

NOTE: Project must be completed within twenty-four months of the day it was approved by the Cultural Properties Review

Committee. For assistance call the Historic Preservation Division (505) 827-6320.

Has credit for this project been claimed in any other taxable year?

NO

YES

If YES, indicate year(s) ______________________________

If the taxpayer is a member of a partnership, limited liability corporation, S corporation, joint venture or similar business

association, complete the following for each partner or member.

Name

SSN/FEIN

Ownership

Percentage

a. _______________________________________

___________________________

________________

b. _______________________________________

___________________________

________________

c. _______________________________________

___________________________

________________

1. Project amount approved this year ........................................................................................... $___________________

2. Project amount approved in prior years .................................................................................... $___________________

3. Total amount approved for this project (Line 1 plus Line 2) ...................................................... $___________________

4. Multiply by ...................................................................................................................................

50%

5. Enter the product of Line 3 x Line 4 OR $25,000, whichever is less. For tax years begin- ...... $___________________

ning on or after January 1, 2009, If the cultural property is also located within an arts and

cultural district, enter the product of Line 3 x Line 4 OR $50,000, whichever is less. This

is the maximum Cultural Properties Preservation Credit available.

6. Credit claimed in prior years ..................................................................................................... $___________________

7. Credit available this year (Line 5 minus Line 6) ........................................................................ $___________________

8. New Mexico liability (from Line 12, Form CIT-1 or Line 4, Form PTE) ...................................... $___________________

Enter the lesser of Line 7 or Line 8 on the appropriate line on Schedules CIT-CR or PTE-CR.

9. Credit available for carryover (Line 7 minus Line 8) ................................................................. $___________________

Unused credits may be carried forward for four consecutive years from the taxable year of the initial claim.

NOTE: Failure to attach this form and the Part 2 approval from the New Mexico Cultural Properties

Review Committee to your income tax return will result in denial of the credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1