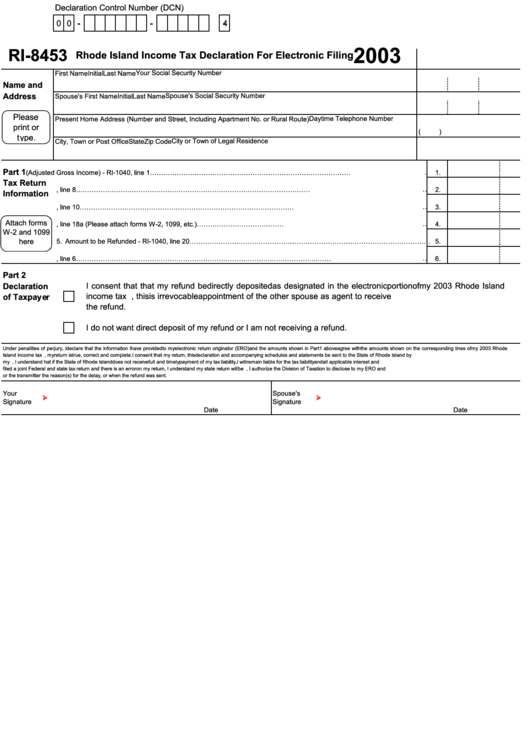

Form Ri-8453 - Rhode Island Income Tax Declaration For Electronic Filing - 2003

ADVERTISEMENT

Declaration Control Number (DCN)

0 0 -

-

- 4

2003

RI-8453

Rhode Island Income Tax Declaration For Electronic Filing

Your Social Security Number

First Name

Initial

Last Name

Name and

Address

Spouse's Social Security Number

Spouse's First Name

Initial

Last Name

Please

Daytime Telephone Number

Present Home Address (Number and Street, Including Apartment No. or Rural Route)

print or

(

)

type.

City, Town or Post Office

State

Zip Code

City or Town of Legal Residence

Part 1

1. Federal AGI (Adjusted Gross Income) - RI-1040, line 1…………………………………………………………………………………

1.

Tax Return

2. Rhode Island Income Tax - RI-1040, line 8………………………………………………………………………………………………

2.

Information

3. Total Rhode Island Income Tax - RI-1040, line 10………………………………………………………………………………………

3.

Attach forms

4. Rhode Island Income Tax Withheld - RI-1040, line 18a (Please attach forms W-2, 1099, etc.)……………………………………

4.

W-2 and 1099

here

5. Amount to be Refunded - RI-1040, line 20………………………………………………………………………………………………

5.

6. Federal exemption - RI-1040, line 6……………………………………………………………………………..………………..………

6.

Part 2

Declaration

I consent that that my refund be directly deposited as designated in the electronic portion of my 2003 Rhode Island

income tax return. If I have filed a joint return, this is irrevocable appointment of the other spouse as agent to receive

of Taxpayer

the refund.

I do not want direct deposit of my refund or I am not receiving a refund.

Under penalities of perjury, I declare that the information I have provided to my electronic return originator (ERO) and the amounts shown in Part 1 above agree with the amounts shown on the corresponding lines of my 2003 Rhode

Island income tax return. To the best of my knowledge and belief, my return is true, correct and complete. I consent that my return, this declaration and accompanying schedules and atatements be sent to the State of Rhode Island by

my ERO. If I have filed a balance due return, I understand hat if the State of Rhode Island does not receive full and timely payment of my tax liability, I will remain liable for the tax liability and all applicable interest and penalities. If I have

filed a joint Federal and state tax return and there is an error on my return, I understand my state return will be rejected. If the processing of my return or refund is delayed, I authorize the Division of Taxation to disclose to my ERO and

or the transmitter the reason(s) for the delay, or when the refund was sent.

Your

Spouse's

Signature

Signature

Date

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1