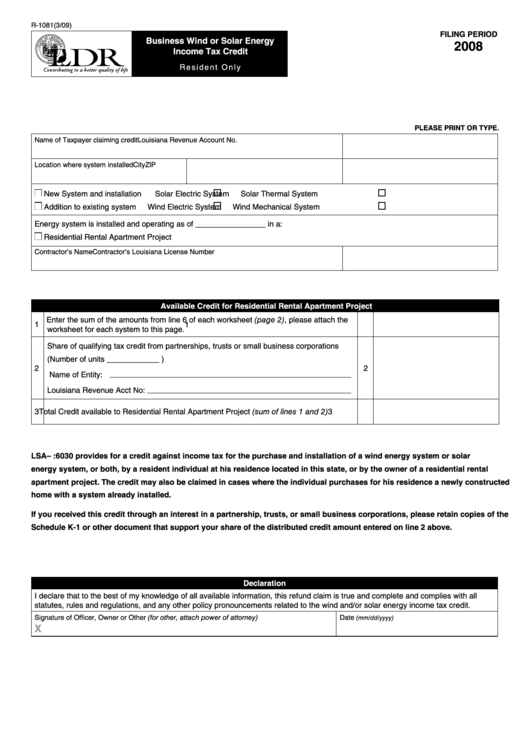

R-1081(3/09)

FILING PERIOD

Business Wind or Solar Energy

2008

Income Tax Credit

R e s i d e n t O n l y

PLEASE PRINT OR TYPE.

Name of Taxpayer claiming credit

Louisiana Revenue Account No.

Location where system installed

City

ZIP

■

■

■

New System and installation

Solar Electric System

Solar Thermal System

■

■

■

Addition to existing system

Wind Electric System

Wind Mechanical System

Energy system is installed and operating as of ________________ in a:

■

Residential Rental Apartment Project

Contractor’s Name

Contractor’s Louisiana License Number

Available Credit for Residential Rental Apartment Project

Enter the sum of the amounts from line 6 of each worksheet (page 2), please attach the

1

1

worksheet for each system to this page.

Share of qualifying tax credit from partnerships, trusts or small business corporations

(Number of units ____________ )

2

2

Name of Entity:

Louisiana Revenue Acct No:

3 Total Credit available to Residential Rental Apartment Project (sum of lines 1 and 2)

3

LSA–R.S. 47:6030 provides for a credit against income tax for the purchase and installation of a wind energy system or solar

energy system, or both, by a resident individual at his residence located in this state, or by the owner of a residential rental

apartment project. The credit may also be claimed in cases where the individual purchases for his residence a newly constructed

home with a system already installed.

If you received this credit through an interest in a partnership, trusts, or small business corporations, please retain copies of the

Schedule K-1 or other document that support your share of the distributed credit amount entered on line 2 above.

Declaration

I declare that to the best of my knowledge of all available information, this refund claim is true and complete and complies with all

statutes, rules and regulations, and any other policy pronouncements related to the wind and/or solar energy income tax credit.

Signature of Officer, Owner or Other (for other, attach power of attorney)

Date

(mm/dd/yyyy)

X

1

1 2

2 3

3