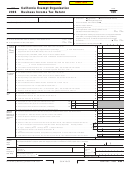

Unrelated Business Taxable Income

Part I

Unrelated Trade or Business Income

1c

1 a Gross receipts or gross sales ______________ b Less returns and allowances ______________ Balance . . . . . .

2

2 Cost of goods sold and/or operations from Schedule A, line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3 Gross profit. Subtract line 2 from line 1c. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4a

4 a Capital gain net income. See Specific Line Instructions – Trusts attach Schedule D (541). . . . . . . . . . . . . . . . .

4b

b Net gain (loss) from Part II, Schedule D-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4c

c Capital loss deduction for trusts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Income (or loss) from partnerships. See specific line instructions. Attach Schedule K-1 (565) or similar schedule . . . . .

6

6 Rental income from Schedule C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7 Unrelated debt-financed income from Schedule D. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Investment income of an R&TC Section 23701g, 23701i, or 23701n organization from Schedule E . . . . . . . . . . . . .

8

9 Annuities, interest, rents and royalties of controlled organizations from Schedule F . . . . . . . . . . . . . . . . . . . . . .

9

10

10 Exploited exempt activity income from Schedule G . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

11 Advertising income from Schedule H, Part III, Column A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Other income. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Total unrelated trade or business income. Add line 3 through line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

Part II

Deductions Not Taken Elsewhere (Except for contributions, deductions must be directly connected with the unrelated business income.)

14 Compensation of officers, directors and trustees from Schedule I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15 Salaries and wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16 Repairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17 Bad debts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18 Interest. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19 Taxes. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20 Contributions. See instructions and attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

21 a Depreciation

(Corporations and Associations – Schedule J) (Trusts – form FTB 3885F)

.

21a

b Less: depreciation claimed on Schedule A . . . . . . . . . . . . . . . . . . . . . . . .

21b

21

22

22 Depletion. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23a

23 a Contributions to deferred compensation plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23b

b Employee benefit programs. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

24 Other deductions. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

25 Total deductions. Add line 14 through line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

26 Unrelated business taxable income before allowable excess advertising costs. Subtract line 25 from line 13 . . . . . . . .

27

27 Excess advertising costs from Schedule H, Part III, Column B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

28 Unrelated business taxable income before specific deduction. Subtract line 27 from line 26 . . . . . . . . . . . . . . . . .

29 Specific deduction. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

30 Unrelated business taxable income. Subtract line 29 from line 28. If less than -0-, enter -0- . . . . . . . . . . . . . . . .

30

Caution: No business expense deduction will be allowed to a taxpayer for expenses incurred at or payments made to a club which restricts

membership or the use of its services or facilities on the basis of age, sex, race, religion, color, ancestry or national origin.

Schedule A Cost of Goods Sold and/or Operations Method of inventory valuation (specify) _______________________________________________

1

1 Inventory at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 Purchases. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3 Cost of labor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4a

4 a Additional IRC Section 263A costs. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4b

b Other costs. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Total. Add line 1 through line 4b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6 Inventory at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Cost of goods sold and/or operations. Subtract line 6 from line 5. Enter here and on Part I, line 2 . . . . . . . . . . . . .

7

Do the rules of IRC Section 263A (with respect to property produced or acquired for resale) apply to this organization?

Yes

No

Schedule B Tax Credits Do not complete if you must file Schedule P (100 or 541).

•

1 Enter credit name

code no.

. . . . . . . . .

1

•

2 Enter credit name

code no.

. . . . . . . . .

2

•

3 Enter credit name

code no.

. . . . . . . . .

3

•

4 Enter credit name

code no.

. . . . . . . . .

4

•

5 Enter credit name

code no.

. . . . . . . . .

5

•

6 Enter credit name

code no.

. . . . . . . . .

6

7 Total. Add line 1 through line 6. Enter here and on Side 1, line 8, for corporations and associations,

•

or line 16 for trusts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

10998209

Side 2 Form 109

1998

C1

1

1 2

2 3

3 4

4 5

5