a. Organizations performing research for the

power of all classes of stock entitled to vote and

are available on California Form 592, Nonresident

government;

at least 80% of the total number of shares of all

Withholding Annual Return.

b. A college, university or hospital performing

other classes of stock of the corporation; or

Salaries, wages or other compensation for personal

•

research for any person; and

Nonstock organization – an organization of which

services are reported on federal Form W-2 and Cali-

c. Organizations operating primarily for

at least 80% of the directors or trustees of such

fornia Form DE-7. For more information regarding

fundamental research.

organization are either representative of or are

information reporting requirements for wages and

directly or indirectly controlled by an exempt

6. Certain investment income for pension funds.

other compensation, contact the Employment Devel-

organization.

These include:

opment Department.

R Exempt Function Income

a. The gains or losses on the lapse or

A reporting requirement exists for interest paid on

termination of securities options

municipal bonds issued by a state other than Califor-

Exempt function income is:

(IRC Section 512(b)(5));

nia, or a municipality other than a California munici-

a. The amount derived from dues, fees, charges or

b. Loan commitment fees (IRC Section

pality and that are held by California taxpayers.

similar amounts of gross income from members;

512(b)(1)); and

Entities paying interest to California taxpayers on

b. The amount (other than gross income derived

c. The gains from the sale, exchange or

these types of bonds are required to report interest

from any unrelated trade or business that is reg-

disposition of real property and mortgages

payments aggregating $10 or more paid after

acquired from financial institutions in conser-

ularly carried on) set aside for religious, charita-

January 1, 1998. Information returns are due June 1,

ble, scientific, literary or educational purposes or

vatorship or receivership (IRC Section

1999. For more information get form FTB 4800, Fed-

for the prevention of cruelty to children or

512(b)(16)).

eral Tax-Exempt Non-California Bond Interest and

animals; and

Interest Dividend Payment.

7. Annual dues not exceeding $100 paid to an

c. In the case of an organization described in

agricultural or horticultural organization described

T Federal Form 990-T

R&TC Section 23701i, the amount set aside for

in IRC Section 512(d).

the payment of life, sick, accident or other

Refer to the Instructions for federal Form 990-T,

Exception

benefits.

Schedule E for further information regarding:

The exclusion rules described above do not apply to

S Information Returns

1. Debt-financed property;

social and recreational clubs (R&TC Section

2. Allocation rules for debt-financed property;

23701g), voluntary employees’ beneficiary associa-

Organizations engaged in an unrelated trade or busi-

3. Acquisition indebtedness;

tions (R&TC Section 23701i) and supplemental

ness may be required to file a federal information

4. Average acquisition indebtedness;

unemployment compensation benefits trusts (R&TC

return with the IRS and the FTB to report certain

5. Average adjusted basis; and

Section 23701n).

payments. Refer to the Instructions for federal

6. Adjusted basis of property.

California law is the same as federal law for organi-

Form 990-T, Other Forms You May Need To File, for

For the special rules for holding companies

zations described in IRC Section 501(c)(7) or

further information.

(R&TC Sections 23701h and 23701x and

501(c)(9).

There are severe penalties for failure to file informa-

IRC Sections 501(c)(2) and 501(c)(25)), see federal

Controlled organization means either a:

tion returns or include correct payee identification

Form 990-T, General Instructions for Consolidated

•

numbers on the returns. Detailed filing instructions

Stock corporation – the ownership of stock pos-

Returns.

sessing at least 80% of the total combined voting

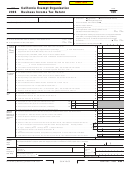

1998 Tax Rate Schedule for Trusts

IF THE TAXABLE INCOME IS . . .

COMPUTED TAX IS . . .

over—

but not over—

of the amount over—

$

0

$

5,131

$

0

+

1.0%

$

0

5,131

12,161

51.31

+

2.0%

5,131

12,161

19,193

191.91

4.0%

12,161

+

19,193

26,644

473.19

6.0%

19,193

+

26,644

33,673

920.25

8.0%

26,644

+

33,673

and over

1,482.57

9.3%

33,673

+

Specific Line Instructions

Apportionment Formula Worksheet

Side 1

(a) Total within

(b) Total within

(c) Percent within

Use only for unrelated trade or

and outside

California

California

(b) ÷ (a)

business amounts

Line 2 – Apportionment Formula

California

Apportion business income of corporations and

1. Property factor: Use the

associations attributable to sources within and out-

average yearly value of owned

side California is apportioned. Use the Apportion-

and rented real and tangible

ment Formula Worksheet to determine the

personal property used in the

apportionment percentage. Retain the worksheet in

your files.

business. See instructions . . . .

2. Payroll factor: Wages,

Instructions for Apportionment Formula

Worksheet —

and other compensation of

employees . . . . . . . . . . . . .

Line 1 – Property factor — Owned property is val-

ued at its original cost. Rented property is valued at

3. Sales factor: Gross sales

eight times its net annual rental.

and/or receipts less returns

Line 6 – Average apportionment percentage —

and allowances . . . . . . . . . .

Divide the total percentage on line 5 by the number

4. Multiply line 3, column (c) by 2 .

of factors that have amounts in column (a). The

sales factor must be counted as two factors. Organi-

5. Total percentage: Add the

zations that have all factors would have a denomina-

percentages in column (c)

tor of four (property, payroll and twice the sales

line 1, line 2 and line 4 . . . . . .

factor). However, do not include those factors with a

zero in the totals of both column (a) and column (b).

6. Average apportionment

Note: Specific Line Instructions are continued on

percentage: Divide line 5 by 4

page 13.

and enter the result here and

on Form 109, Side 1, line 2.

See instructions . . . . . . . . . .

Page 4

Form 109 Instructions 1998

1

1 2

2 3

3 4

4 5

5