Instructions For Form K-130/130as

ADVERTISEMENT

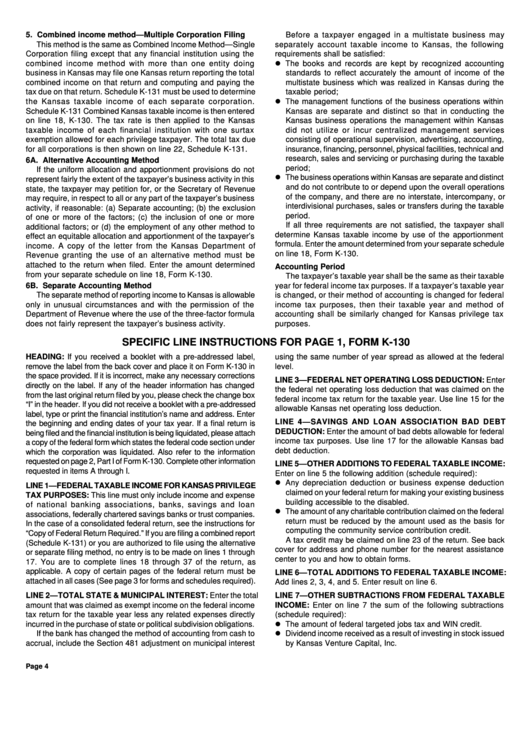

5. Combined income method—Multiple Corporation Filing

Before a taxpayer engaged in a multistate business may

This method is the same as Combined Income Method—Single

separately account taxable income to Kansas, the following

Corporation filing except that any financial institution using the

requirements shall be satisfied:

combined income method with more than one entity doing

The books and records are kept by recognized accounting

business in Kansas may file one Kansas return reporting the total

standards to reflect accurately the amount of income of the

combined income on that return and computing and paying the

multistate business which was realized in Kansas during the

tax due on that return. Schedule K-131 must be used to determine

taxable period;

the Kansas taxable income of each separate corporation.

The management functions of the business operations within

Schedule K-131 Combined Kansas taxable income is then entered

Kansas are separate and distinct so that in conducting the

on line 18, K-130. The tax rate is then applied to the Kansas

Kansas business operations the management within Kansas

taxable income of each financial institution with one surtax

did not utilize or incur centralized management services

exemption allowed for each privilege taxpayer. The total tax due

consisting of operational supervision, advertising, accounting,

for all corporations is then shown on line 22, Schedule K-131.

insurance, financing, personnel, physical facilities, technical and

research, sales and servicing or purchasing during the taxable

6A. Alternative Accounting Method

period;

If the uniform allocation and apportionment provisions do not

The business operations within Kansas are separate and distinct

represent fairly the extent of the taxpayer’s business activity in this

and do not contribute to or depend upon the overall operations

state, the taxpayer may petition for, or the Secretary of Revenue

of the company, and there are no interstate, intercompany, or

may require, in respect to all or any part of the taxpayer’s business

interdivisional purchases, sales or transfers during the taxable

activity, if reasonable: (a) Separate accounting; (b) the exclusion

period.

of one or more of the factors; (c) the inclusion of one or more

If all three requirements are not satisfied, the taxpayer shall

additional factors; or (d) the employment of any other method to

determine Kansas taxable income by use of the apportionment

effect an equitable allocation and apportionment of the taxpayer’s

formula. Enter the amount determined from your separate schedule

income. A copy of the letter from the Kansas Department of

on line 18, Form K-130.

Revenue granting the use of an alternative method must be

attached to the return when filed. Enter the amount determined

Accounting Period

from your separate schedule on line 18, Form K-130.

The taxpayer’s taxable year shall be the same as their taxable

6B. Separate Accounting Method

year for federal income tax purposes. If a taxpayer’s taxable year

The separate method of reporting income to Kansas is allowable

is changed, or their method of accounting is changed for federal

only in unusual circumstances and with the permission of the

income tax purposes, then their taxable year and method of

Department of Revenue where the use of the three-factor formula

accounting shall be similarly changed for Kansas privilege tax

does not fairly represent the taxpayer’s business activity.

purposes.

SPECIFIC LINE INSTRUCTIONS FOR PAGE 1, FORM K-130

HEADING: If you received a booklet with a pre-addressed label,

using the same number of year spread as allowed at the federal

remove the label from the back cover and place it on Form K-130 in

level.

the space provided. If it is incorrect, make any necessary corrections

LINE 3—FEDERAL NET OPERATING LOSS DEDUCTION: Enter

directly on the label. If any of the header information has changed

the federal net operating loss deduction that was claimed on the

from the last original return filed by you, please check the change box

federal income tax return for the taxable year. Use line 15 for the

“I” in the header. If you did not receive a booklet with a pre-addressed

allowable Kansas net operating loss deduction.

label, type or print the financial institution’s name and address. Enter

LINE 4—SAVINGS AND LOAN ASSOCIATION BAD DEBT

the beginning and ending dates of your tax year. If a final return is

DEDUCTION: Enter the amount of bad debts allowable for federal

being filed and the financial institution is being liquidated, please attach

income tax purposes. Use line 17 for the allowable Kansas bad

a copy of the federal form which states the federal code section under

debt deduction.

which the corporation was liquidated. Also refer to the information

requested on page 2, Part I of Form K-130. Complete other information

LINE 5—OTHER ADDITIONS TO FEDERAL TAXABLE INCOME:

requested in items A through I.

Enter on line 5 the following addition (schedule required):

Any depreciation deduction or business expense deduction

LINE 1—FEDERAL TAXABLE INCOME FOR KANSAS PRIVILEGE

claimed on your federal return for making your existing business

TAX PURPOSES: This line must only include income and expense

building accessible to the disabled.

of national banking associations, banks, savings and loan

The amount of any charitable contribution claimed on the federal

associations, federally chartered savings banks or trust companies.

return must be reduced by the amount used as the basis for

In the case of a consolidated federal return, see the instructions for

computing the community service contribution credit.

“Copy of Federal Return Required.” If you are filing a combined report

A tax credit may be claimed on line 23 of the return. See back

(Schedule K-131) or you are authorized to file using the alternative

cover for address and phone number for the nearest assistance

or separate filing method, no entry is to be made on lines 1 through

center to you and how to obtain forms.

17. You are to complete lines 18 through 37 of the return, as

applicable. A copy of certain pages of the federal return must be

LINE 6—TOTAL ADDITIONS TO FEDERAL TAXABLE INCOME:

attached in all cases (See page 3 for forms and schedules required).

Add lines 2, 3, 4, and 5. Enter result on line 6.

LINE 2—TOTAL STATE & MUNICIPAL INTEREST: Enter the total

LINE 7—OTHER SUBTRACTIONS FROM FEDERAL TAXABLE

amount that was claimed as exempt income on the federal income

INCOME: Enter on line 7 the sum of the following subtractions

tax return for the taxable year less any related expenses directly

(schedule required):

incurred in the purchase of state or political subdivision obligations.

The amount of federal targeted jobs tax and WIN credit.

If the bank has changed the method of accounting from cash to

Dividend income received as a result of investing in stock issued

accrual, include the Section 481 adjustment on municipal interest

by Kansas Venture Capital, Inc.

Page 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4