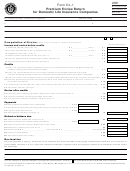

Form Dl-2 - Investment Privilege Excise Return For Domestic Life Insurance Companies - Massachusetts Department Of Revenue - 2003 Page 2

ADVERTISEMENT

Schedule A. Income Apportionment

11 Massachusetts premiums (from NAIC Annual Statement Schedule T, line 22, cols. 2, 3 and 4).

Exclude premiums (if included) for company employees’ group plans . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Premiums in jurisdictions where no insurance tax is paid (from Schedule T, cols. 2, 3 and 4) . . . . . . 2

13 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Total premiums (from Schedule T, line 94, cols. 2, 3 and 4). Exclude premiums (if included) for

company employees’ group plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

15 Adjustments to total premiums (from Schedule T, cols. 3, 4 and 5)

a Dividends to purchase paid-up additions and annuities (from line 91) . . . . . . . . . . . . . . . . . . . . . 5a

b Dividends to shorten endowment or premium paying period (from line 92) . . . . . . . . . . . . . . . . . 5b

c Considerations waived under contract provisions (from line 93) . . . . . . . . . . . . . . . . . . . . . . . . . 5c

d Add lines 5a through 5c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5d

16 Adjusted total premiums. Subtract line 5d from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17 Massachusetts premium apportionment percentage. Divide line 3 by line 6 . . . . . . . . . . . . . . . . $ ________________ × 9 = 7

%

18 Massachusetts wages, salaries, commissions and other remuneration. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Total wages, salaries, commissions and other remuneration. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Massachusetts payroll apportionment percentage. Divide line 8 by line 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

%

11 Total apportionment percentage. Add lines 7 and 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

%

12 Massachusetts apportionment percentage. Divide line 11 by 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

%

13 Applicable apportionment percentage (line 12 or .20, whichever is less). Enter here and in Schedule C, line 8. . . . . . . . . . . . 13

%

Schedule B. Dividends Deduction

Include separate account amounts in each line, if separately stated on Pro Forma 1120L.

11 Total dividends (Pro Forma 1120L, Schedule A, lines 2a through 2e, multiplied by Schedule C, line 3, Pro Forma 1120L) . . . . 1

12 Dividends from Massachusetts corporate trusts included in line 1 (attach schedule) . . . . . . . . . . . . . 2

13 Dividends from non-wholly-owned DISCs included in line 1 (attach schedule). . . . . . . . . . . . . . . . . . 3

14 Dividends, if less than 15% of voting stock owned, included in line 1:

a On common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4a

b On preferred stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b

15 Total taxable dividends. Add lines 2 through 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16 Dividends deduction. Attach schedule showing payers, amounts and percentage of voting stock owned by class of stock.

Subtract line 5 from line 1. Enter here and in Schedule C, line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Schedule C. Taxable Investment Income

Include separate account amounts in each line, if separately stated on Pro Forma 1120L.

11 Taxable investment income as shown in Schedule C, line 12, Pro Forma 1120L*. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 State and municipal bond interest not included in line 1 (from Schedule C, line 8b, Pro Forma 1120L) . . . . . . . . . . . . . . . . . . . 2

13 Foreign, state or local income, franchise, excise, capital stock or premium taxes deducted from federal investment income. . . . 3

14 Dividends received deduction (from Schedule C, line 9f, Pro Forma 1120L) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿4

15 Add lines 1 through 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16 Dividends deduction (from Schedule B, line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 6

17 Income subject to apportionment. Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 7

18 Income apportionment percentage (from Schedule A, line 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 8

%

19 Massachusetts taxable investment income. Multiply line 7 by line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

*Companies to which Section 22D of Chapter 63 of the Massachusetts General Laws applies must attach a reconciliation if the amount shown on this line

differs from Schedule C, line 12, Pro Forma 1120L.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2