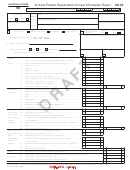

Arizona Form 99 Draft - Arizona Exempt Organization Annual Information Return - 2010 Page 2

ADVERTISEMENT

Name:

EIN:

AZ Form 99 (2010)

Page 2 of 2

Schedule A - Balance Sheet

(a)

(b)

NOTE: Amounts used in attached schedules and in this column should be end of year amounts.

Beginning of year

End of year

Assets

A1

Cash.........................................................................................................................

00

A1

00

A2a Accounts receivable .................................................. A2a

00

b Less: allowance for doubtful accounts ................... A2b

00

c Line A2a less line A2b. Enter difference in column (b) ..........................................

00 A2c

00

A3a Other notes and loans receivable - attach schedule .. A3a

00

b Less: allowance for doubtful accounts ................... A3b

00

c Line A3a less line A3b. Enter difference in column (b) ..........................................

00 A3c

00

A4

Inventories ...............................................................................................................

00

A4

00

A5

Investments (securities) - attach schedule ...............................................................

00

A5

00

A6

Investments (other) - attach schedule ......................................................................

00

A6

00

A7a Land, buildings, and equipment; basis...................... A7a

00

b Less: accumulated depreciation - attach schedule A7b

00

c Line A7a less line A7b. Enter difference in column (b) ..........................................

00 A7c

00

A8

Other assets - describe _____________________________________________

00

A8

00

A9

Total assets - add lines A1 through A8 ................................................................

00

A9

00

Liabilities

A10 Accounts payable and accrued expenses ...............................................................

00 A10

00

A11 Mortgages and other notes payable - attach schedule ............................................

00 A11

00

A12 Other liabilities - describe .........................................................................................

00 A12

00

A13 Total liabilities - add lines A10 through A12 ........................................................

00 A13

00

Net Assets

A14 Capital stock or trust principal ..................................................................................

00 A14

00

A15 Paid-in or capital surplus ..........................................................................................

00 A15

00

A16 Retained earnings or accumulated income ..............................................................

00 A16

00

A17 Total net assets - add lines A14 through A16......................................................

00 A17

00

A18 Total liabilities and net assets - add lines A13 and A17 .....................................

00 A18

00

Certifi cation

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief, it is a true, correct and complete return, made in good faith, for the taxable year stated pursuant to the income tax laws of the State of Arizona.

Please

Offi cer’s signature

Date

Title

Sign Here

Paid

Preparer’s

Preparer’s signature

Date

Preparer’s EIN, PTIN or SSN

Use Only

Firm’s name (or preparer’s, if self-employed)

Firm’s

EIN or

SSN

(

)

Firm’s address

Zip code

Firm’s telephone number

Mail to: Arizona Department of Revenue, PO Box 52153, Phoenix AZ 85072-2153

ADOR 10418 (10)

Previous ADOR 91-0022

DRAFT 9/9/10, 11:40 a.m.

DRAFT 9/9/10, 11:40 a.m.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2