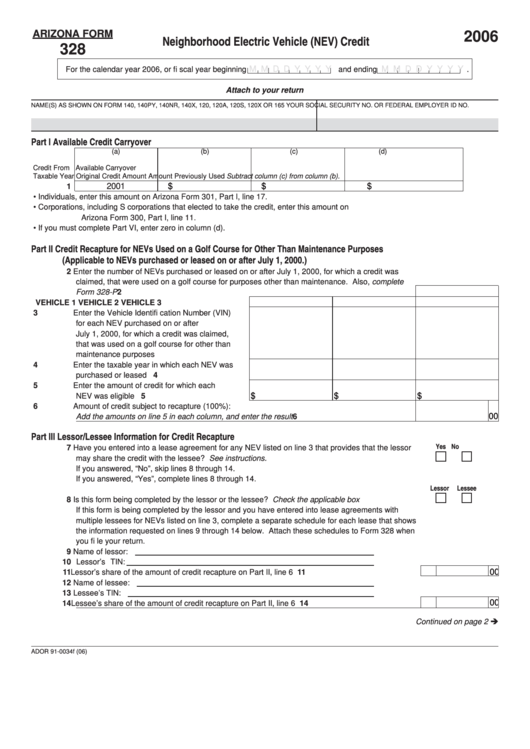

ARIZONA FORM

2006

Neighborhood Electric Vehicle (NEV) Credit

328

M M D D Y Y Y Y

M M D D Y Y Y Y

For the calendar year 2006, or fi scal year beginning

and ending

.

Attach to your return

NAME(S) AS SHOWN ON FORM 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X OR 165

YOUR SOCIAL SECURITY NO. OR FEDERAL EMPLOYER ID NO.

Part I

Available Credit Carryover

(a)

(b)

(c)

(d)

Credit From

Available Carryover

Taxable Year

Original Credit Amount

Amount Previously Used

Subtract column (c) from column (b).

2001

$

$

$

1

• Individuals, enter this amount on Arizona Form 301, Part I, line 17.

• Corporations, including S corporations that elected to take the credit, enter this amount on

Arizona Form 300, Part I, line 11.

• If you must complete Part VI, enter zero in column (d).

Part II Credit Recapture for NEVs Used on a Golf Course for Other Than Maintenance Purposes

(Applicable to NEVs purchased or leased on or after July 1, 2000.)

2 Enter the number of NEVs purchased or leased on or after July 1, 2000, for which a credit was

claimed, that were used on a golf course for purposes other than maintenance. Also, complete

Form 328-P ..................................................................................................................................

2

VEHICLE 1

VEHICLE 2

VEHICLE 3

3 Enter the Vehicle Identifi cation Number (VIN)

for each NEV purchased on or after

July 1, 2000, for which a credit was claimed,

that was used on a golf course for other than

maintenance purposes ...................................... 3

4 Enter the taxable year in which each NEV was

purchased or leased .......................................... 4

5 Enter the amount of credit for which each

$

$

$

NEV was eligible ................................................ 5

6 Amount of credit subject to recapture (100%):

00

Add the amounts on line 5 in each column, and enter the result .................................................

6

Part III Lessor/Lessee Information for Credit Recapture

Yes

No

7 Have you entered into a lease agreement for any NEV listed on line 3 that provides that the lessor

may share the credit with the lessee? See instructions. ....................................................................

If you answered, “No”, skip lines 8 through 14.

If you answered, “Yes”, complete lines 8 through 14.

Lessor

Lessee

8 Is this form being completed by the lessor or the lessee? Check the applicable box .......................

If this form is being completed by the lessor and you have entered into lease agreements with

multiple lessees for NEVs listed on line 3, complete a separate schedule for each lease that shows

the information requested on lines 9 through 14 below. Attach these schedules to Form 328 when

you fi le your return.

9 Name of lessor:

10 Lessor’s TIN:

11 Lessor’s share of the amount of credit recapture on Part II, line 6 .....................................................

11

00

12 Name of lessee:

13 Lessee’s TIN:

00

14 Lessee’s share of the amount of credit recapture on Part II, line 6 ....................................................

14

Continued on page 2

ADOR 91-0034f (06)

1

1 2

2