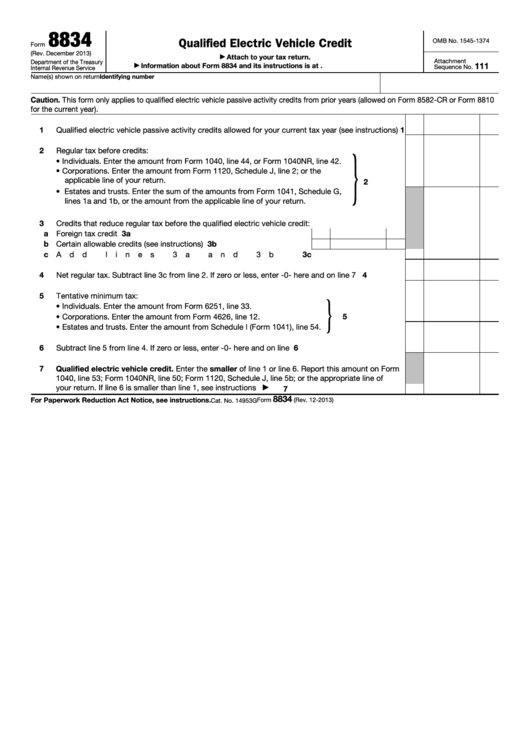

8834

Qualified Electric Vehicle Credit

OMB No. 1545-1374

Form

(Rev. December 2013)

Attach to your tax return.

▶

Attachment

Department of the Treasury

111

Information about Form 8834 and its instructions is at

▶

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

Caution. This form only applies to qualified electric vehicle passive activity credits from prior years (allowed on Form 8582-CR or Form 8810

for the current year).

1

Qualified electric vehicle passive activity credits allowed for your current tax year (see instructions)

1

}

2

Regular tax before credits:

• Individuals. Enter the amount from Form 1040, line 44, or Form 1040NR, line 42.

• Corporations. Enter the amount from Form 1120, Schedule J, line 2; or the

applicable line of your return.

.

.

.

.

2

• Estates and trusts. Enter the sum of the amounts from Form 1041, Schedule G,

lines 1a and 1b, or the amount from the applicable line of your return.

3

Credits that reduce regular tax before the qualified electric vehicle credit:

a Foreign tax credit .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3a

b Certain allowable credits (see instructions) .

.

.

.

.

.

.

.

.

.

3b

c Add lines 3a and 3b

3c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

Net regular tax. Subtract line 3c from line 2. If zero or less, enter -0- here and on line 7

.

.

.

.

4

}

5

Tentative minimum tax:

• Individuals. Enter the amount from Form 6251, line 33.

.

.

.

.

.

.

• Corporations. Enter the amount from Form 4626, line 12.

5

• Estates and trusts. Enter the amount from Schedule I (Form 1041), line 54.

6

Subtract line 5 from line 4. If zero or less, enter -0- here and on line 7 .

.

.

.

.

.

.

.

.

.

6

7

Qualified electric vehicle credit. Enter the smaller of line 1 or line 6. Report this amount on Form

1040, line 53; Form 1040NR, line 50; Form 1120, Schedule J, line 5b; or the appropriate line of

your return. If line 6 is smaller than line 1, see instructions

.

.

.

.

.

.

.

.

.

.

.

.

7

▶

8834

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2013)

Cat. No. 14953G

1

1 2

2