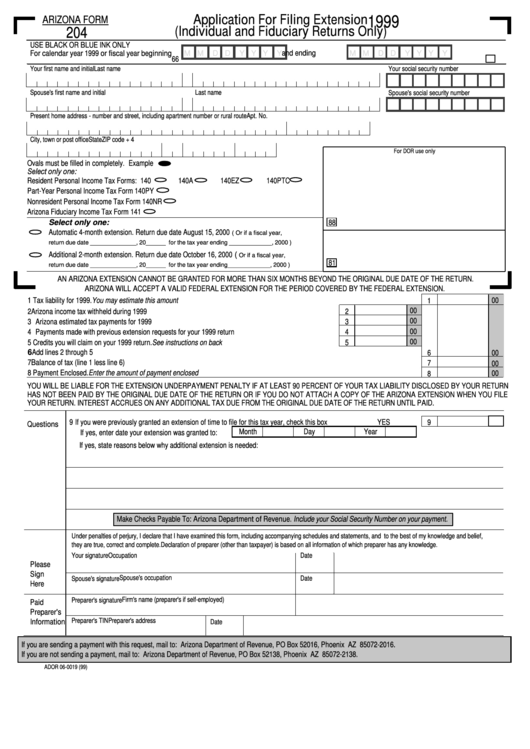

Form 204 - Application For Filing Extension (Individual And Fiduciary Returns Only) - 1999

ADVERTISEMENT

Application For Filing Extension

1999

ARIZONA FORM

204

(Individual and Fiduciary Returns Only)

USE BLACK OR BLUE INK ONLY

For calendar year 1999 or fiscal year beginning

and ending

M M

D D

Y Y Y

Y

M M

D D

Y Y Y

Y

66

Your first name and initial

Last name

Your social security number

Spouse's first name and initial

Last name

Spouse's social security number

Present home address - number and street, including apartment number or rural route

Apt. No.

City, town or post office

State

ZIP code + 4

For DOR use only

Ovals must be filled in completely. Example

Select only one:

Resident Personal Income Tax Forms: 140

140A

140EZ

140PTC

Part-Year Personal Income Tax Form 140PY

Nonresident Personal Income Tax Form 140NR

Arizona Fiduciary Income Tax Form 141

88

Select only one:

Automatic 4-month extension. Return due date August 15, 2000

( Or if a fiscal year,

return due date ______________, 20______ for the tax year ending _____________, 2000 )

Additional 2-month extension. Return due date October 16, 2000 (

Or if a fiscal year,

81

return due date ______________, 20______ for the tax year ending_____________, 2000 )

AN ARIZONA EXTENSION CANNOT BE GRANTED FOR MORE THAN SIX MONTHS BEYOND THE ORIGINAL DUE DATE OF THE RETURN.

ARIZONA WILL ACCEPT A VALID FEDERAL EXTENSION FOR THE PERIOD COVERED BY THE FEDERAL EXTENSION.

1 Tax liability for 1999. You may estimate this amount ....................................................................................................................................

00

1

00

2 Arizona income tax withheld during 1999 .......................................................................................................

2

00

3 Arizona estimated tax payments for 1999 ......................................................................................................

3

00

4 Payments made with previous extension requests for your 1999 return ........................................................

4

00

5 Credits you will claim on your 1999 return. See instructions on back ............................................................

5

6 Add lines 2 through 5 ....................................................................................................................................................................................

6

00

7 Balance of tax (line 1 less line 6) .................................................................................................................................................................

7

00

8 Payment Enclosed. Enter the amount of payment enclosed ........................................................................................................................

00

8

YOU WILL BE LIABLE FOR THE EXTENSION UNDERPAYMENT PENALTY IF AT LEAST 90 PERCENT OF YOUR TAX LIABILITY DISCLOSED BY YOUR RETURN

HAS NOT BEEN PAID BY THE ORIGINAL DUE DATE OF THE RETURN OR IF YOU DO NOT ATTACH A COPY OF THE ARIZONA EXTENSION WHEN YOU FILE

YOUR RETURN. INTEREST ACCRUES ON ANY ADDITIONAL TAX DUE FROM THE ORIGINAL DUE DATE OF THE RETURN UNTIL PAID.

9 If you were previously granted an extension of time to file for this tax year, check this box ................................................

9

YES

Questions

Month

Day

Year

If yes, enter date your extension was granted to:

If yes, state reasons below why additional extension is needed:

Make Checks Payable To: Arizona Department of Revenue. Include your Social Security Number on your payment.

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my knowledge and belief,

they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature

Date

Occupation

Please

Sign

Spouse's occupation

Spouse's signature

Date

Here

Firm's name (preparer's if self-employed)

Preparer's signature

Paid

Preparer's

Preparer's TIN

Preparer's address

Information

Date

If you are sending a payment with this request, mail to: Arizona Department of Revenue, PO Box 52016, Phoenix AZ 85072-2016.

If you are not sending a payment, mail to: Arizona Department of Revenue, PO Box 52138, Phoenix AZ 85072-2138.

ADOR 06-0019 (99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1