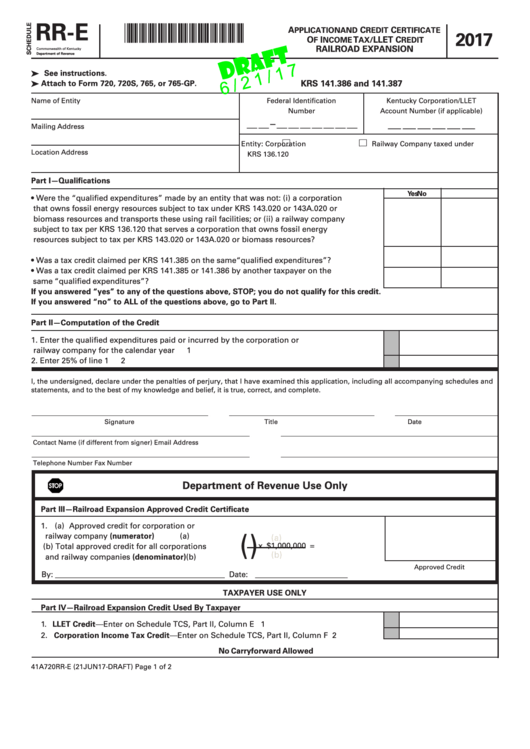

Form 41a720rr-E Draft - Schedule Rr-E - Application And Credit Certificate Of Income Tax/llet Credit Railroad Expansion - 2017

ADVERTISEMENT

RR-E

*1700010317*

A

C

C

PPLICATION AND

REDIT

ERTIFICATE

2017

O

I

T

LLET C

F

NCOME

AX/

REDIT

RAILROAD EXPANSION

Commonwealth of Kentucky

Department of Revenue

ä See instructions.

KRS 141.386 and 141.387

ä Attach to Form 720, 720S, 765, or 765-GP .

Name of Entity

Federal Identification

Kentucky Corporation/LLET

Number

Account Number (if applicable)

__ __ __ __ __ __

__ __ – __ __ __ __ __ __ __

Mailing Address

Entity:

Corporation

Railway Company taxed under

Location Address

KRS 136.120

Part I—Qualifications

Yes

No

•

Were the “qualified expenditures” made by an entity that was not: (i) a corporation

that owns fossil energy resources subject to tax under KRS 143.020 or 143A.020 or

biomass resources and transports these using rail facilities; or (ii) a railway company

subject to tax per KRS 136.120 that serves a corporation that owns fossil energy

resources subject to tax per KRS 143.020 or 143A.020 or biomass resources? .......................

•

Was a tax credit claimed per KRS 141.385 on the same“qualified expenditures”? .................

•

Was a tax credit claimed per KRS 141.385 or 141.386 by another taxpayer on the

same “qualified expenditures”? ...................................................................................................

If you answered “yes” to any of the questions above, STOP; you do not qualify for this credit.

If you answered “no” to ALL of the questions above, go to Part II.

Part II—Computation of the Credit

1. Enter the qualified expenditures paid or incurred by the corporation or

railway company for the calendar year ........................................................................................

1

2. Enter 25% of line 1 ..........................................................................................................................

2

I, the undersigned, declare under the penalties of perjury, that I have examined this application, including all accompanying schedules and

statements, and to the best of my knowledge and belief, it is true, correct, and complete.

Signature

Title

Date

Contact Name (if different from signer)

Email Address

Telephone Number

Fax Number

Department of Revenue Use Only

Part III—Railroad Expansion Approved Credit Certificate

1. (a) Approved credit for corporation or

(

)

railway company (numerator) ..................... (a)

(a)

x $1,000,000 =

(b) Total approved credit for all corporations

(b)

and railway companies (denominator) ....... (b)

Approved Credit

By: ____________________________________________ Date: ________________________

TAXPAYER USE ONLY

Part IV—Railroad Expansion Credit Used By Taxpayer

1. LLET Credit—Enter on Schedule TCS, Part II, Column E .........................................................

1

2. Corporation Income Tax Credit—Enter on Schedule TCS, Part II, Column F .........................

2

No Carryforward Allowed

41A720RR-E (21JUN17-DRAFT)

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2