Form 41 Draft - Fiduciary Income Tax Return-Alabama Department Of Revenue- 2006 Page 3

ADVERTISEMENT

*0612830341*

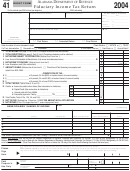

FORM

41

2006

Alabama Fiduciary Income Tax Return

PAGE 3

Name of estate or trust

Employer identification number

Name and title of fiduciary

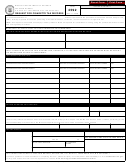

SCHEDULE C – COMPUTATION OF TOTAL ORDINARY DEDUCTIONS

Column B

Column C

Column A

ALABAMA AMOUNT

DIFFERENCE

FEDERAL FORM 1041

Ordinary Deductions:

1

1 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 Taxes (other than Federal Estate Tax or Federal Income Tax) . . . . . . . . .

3

3 Fiduciary fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4 Charitable deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Attorney, accountant, and return preparer fees . . . . . . . . . . . . . . . . . . . . .

6

6 Other deductions not subject to the 2% floor . . . . . . . . . . . . . . . . . . . . . . .

7

7 Allowable miscellaneous itemized deductions subject to the 2% floor . .

8

8 Total Ordinary Deductions (Sum of Lines 1 through 7) . . . . . . . . . . . . .

Reconciliation of Difference

Check if any amount entered in Column B was computed on Alabama Schedule 41-NR

9

9 State, local and foreign income taxes deducted on the federal return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

10

11

11

12

12

13

13

14

14 Difference in Federal and Alabama Total Ordinary Deductions (Sum of Lines 9 through 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SCHEDULE DNI – COMPUTATION OF ALABAMA DISTRIBUTABLE NET INCOME

ALABAMA AMOUNT

1

1 Alabama Adjusted total income or (loss) from Page 1, Schedule A, Line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 The amount of gain from the sale of capital assets, but only if the gain was allocated to corpus and not paid, credited,

2

or required to be distributed to any beneficiary during the taxable year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3 Subtract the amount entered on Line 2 from the amount entered on Line 1, and enter in Line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 The amount of loss from the sale of capital assets – entered as a positive number, but only if the loss was not considered in

4

the determination of the amount to be paid, credited, or required to be distributed to any beneficiary during taxable year. . . . . . . . . . . . .

5

5 Amount of tax exempt interest income excluded in computing Alabama taxable income.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6 Other adjustments – see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7 Alabama Distributable Net Income (Sum of Lines 3 through 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5