Form Tbor-1 - Declaration Of Tax Representative

ADVERTISEMENT

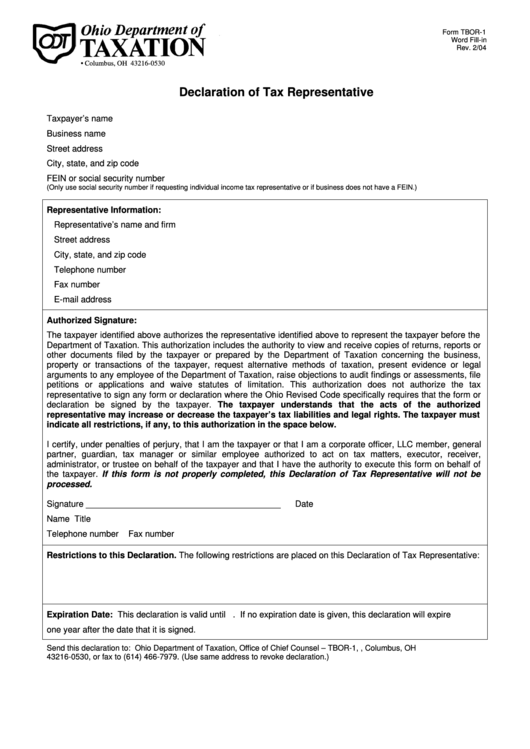

Form TBOR-1

Word Fill-in

Rev. 2/04

P.O. Box 530 • Columbus, OH 43216-0530

Declaration of Tax Representative

Taxpayer’s name

Business name

Street address

City, state, and zip code

FEIN or social security number

(Only use social security number if requesting individual income tax representative or if business does not have a FEIN.)

Representative Information:

Representative’s name and firm

Street address

City, state, and zip code

Telephone number

Fax number

E-mail address

Authorized Signature:

The taxpayer identified above authorizes the representative identified above to represent the taxpayer before the

Department of Taxation. This authorization includes the authority to view and receive copies of returns, reports or

other documents filed by the taxpayer or prepared by the Department of Taxation concerning the business,

property or transactions of the taxpayer, request alternative methods of taxation, present evidence or legal

arguments to any employee of the Department of Taxation, raise objections to audit findings or assessments, file

petitions or applications and waive statutes of limitation. This authorization does not authorize the tax

representative to sign any form or declaration where the Ohio Revised Code specifically requires that the form or

declaration be signed by the taxpayer. The taxpayer understands that the acts of the authorized

representative may increase or decrease the taxpayer’s tax liabilities and legal rights. The taxpayer must

indicate all restrictions, if any, to this authorization in the space below.

I certify, under penalties of perjury, that I am the taxpayer or that I am a corporate officer, LLC member, general

partner, guardian, tax manager or similar employee authorized to act on tax matters, executor, receiver,

administrator, or trustee on behalf of the taxpayer and that I have the authority to execute this form on behalf of

the taxpayer. If this form is not properly completed, this Declaration of Tax Representative will not be

processed.

Signature _________________________________________

Date

Name

Title

Telephone number

Fax number

Restrictions to this Declaration. The following restrictions are placed on this Declaration of Tax Representative:

Expiration Date: This declaration is valid until

. If no expiration date is given, this declaration will expire

one year after the date that it is signed.

Send this declaration to: Ohio Department of Taxation, Office of Chief Counsel – TBOR-1, P.O. Box 530, Columbus, OH

43216-0530, or fax to (614) 466-7979. (Use same address to revoke declaration.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1