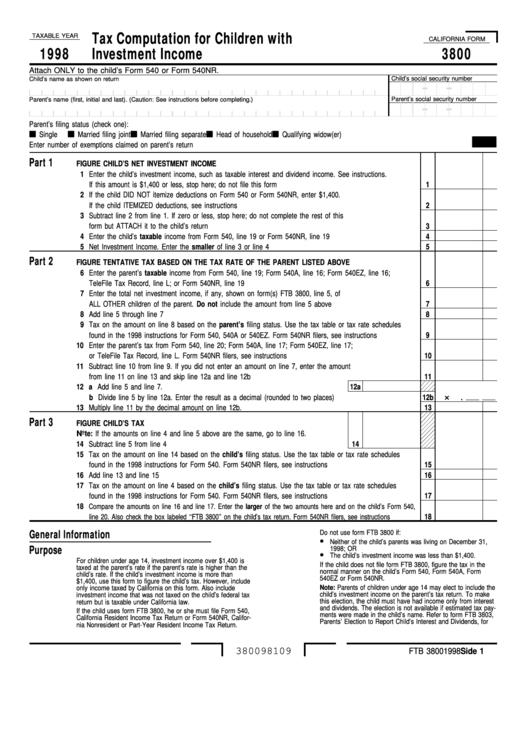

Tax Computation for Children with

TAXABLE YEAR

CALIFORNIA FORM

1998

Investment Income

3800

Attach ONLY to the child’s Form 540 or Form 540NR.

Child’s social security number

Child’s name as shown on return

Parent’s name (first, initial and last). (Caution: See instructions before completing.)

Parent’s social security number

Parent’s filing status (check one):

Single

Married filing joint

Married filing separate

Head of household

Qualifying widow(er)

Enter number of exemptions claimed on parent’s return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part 1

FIGURE CHILD’S NET INVESTMENT INCOME

1 Enter the child’s investment income, such as taxable interest and dividend income. See instructions.

If this amount is $1,400 or less, stop here; do not file this form . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 If the child DID NOT itemize deductions on Form 540 or Form 540NR, enter $1,400.

If the child ITEMIZED deductions, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Subtract line 2 from line 1. If zero or less, stop here; do not complete the rest of this

form but ATTACH it to the child’s return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Enter the child’s taxable income from Form 540, line 19 or Form 540NR, line 19 . . . . . . . . . . . . . . . . .

4

5 Net Investment Income. Enter the smaller of line 3 or line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Part 2

FIGURE TENTATIVE TAX BASED ON THE TAX RATE OF THE PARENT LISTED ABOVE

6 Enter the parent’s taxable income from Form 540, line 19; Form 540A, line 16; Form 540EZ, line 16;

TeleFile Tax Record, line L; or Form 540NR, line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Enter the total net investment income, if any, shown on form(s) FTB 3800, line 5, of

ALL OTHER children of the parent. Do not include the amount from line 5 above . . . . . . . . . . . . . . . . .

7

8 Add line 5 through line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Tax on the amount on line 8 based on the parent’s filing status. Use the tax table or tax rate schedules

found in the 1998 instructions for Form 540, 540A or 540EZ. Form 540NR filers, see instructions . . . . . . . .

9

10 Enter the parent’s tax from Form 540, line 20; Form 540A, line 17; Form 540EZ, line 17;

or TeleFile Tax Record, line L. Form 540NR filers, see instructions . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Subtract line 10 from line 9. If you did not enter an amount on line 7, enter the amount

from line 11 on line 13 and skip line 12a and line 12b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 a Add line 5 and line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12a

× .

b Divide line 5 by line 12a. Enter the result as a decimal (rounded to two places) . . . . . . . . . . . . . . . .

12b

13

13 Multiply line 11 by the decimal amount on line 12b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part 3

FIGURE CHILD’S TAX

Note: If the amounts on line 4 and line 5 above are the same, go to line 16.

14 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15 Tax on the amount on line 14 based on the child’s filing status. Use the tax table or tax rate schedules

found in the 1998 instructions for Form 540. Form 540NR filers, see instructions. . . . . . . . . . . . . . . . . .

15

16 Add line 13 and line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17 Tax on the amount on line 4 based on the child’s filing status. Use the tax table or tax rate schedules

found in the 1998 instructions for Form 540. Form 540NR filers, see instructions. . . . . . . . . . . . . . . . . .

17

18

Compare the amounts on line 16 and line 17. Enter the larger of the two amounts here and on the child’s Form 540,

18

line 20. Also check the box labeled ‘‘FTB 3800’’ on the child’s tax return. Form 540NR filers, see instructions. . . . .

Do not use form FTB 3800 if:

General Information

•

Neither of the child’s parents was living on December 31,

Purpose

1998; OR

•

The child’s investment income was less than $1,400.

For children under age 14, investment income over $1,400 is

If the child does not file form FTB 3800, figure the tax in the

taxed at the parent’s rate if the parent’s rate is higher than the

normal manner on the child’s Form 540, Form 540A, Form

child’s rate. If the child’s investment income is more than

540EZ or Form 540NR.

$1,400, use this form to figure the child’s tax. However, include

Note: Parents of children under age 14 may elect to include the

only income taxed by California on this form. Also include

child’s investment income on the parent’s tax return. To make

investment income that was not taxed on the child’s federal tax

this election, the child must have had income only from interest

return but is taxable under California law.

and dividends. The election is not available if estimated tax pay-

If the child uses form FTB 3800, he or she must file Form 540,

ments were made in the child’s name. Refer to form FTB 3803,

California Resident Income Tax Return or Form 540NR, Califor-

Parents’ Election to Report Child’s Interest and Dividends, for

nia Nonresident or Part-Year Resident Income Tax Return.

380098109

FTB 3800 1998 Side 1

1

1