Instructions For Form 472f - Application For Food Tax Refund - Missouri Department Of Revenue - 1997

ADVERTISEMENT

INSTRUCTIONS FOR COMPLETING THIS APPLICATION

BUSINESS NAME/TAX IDENTIFICATION NUMBER: Insert the name and Missouri sales/use tax identification number of the business (as

registered with the Department of Revenue) applying for the refund.

NAME TO BE TYPED ON CHECK: Use this space if the check is to be issued in a name other than the “business name”.

PHONE NUMBER: Enter the phone number where inquiries concerning the refund should be directed.

MAILING ADDRESS: Enter the mailing address where the refund check should be mailed.

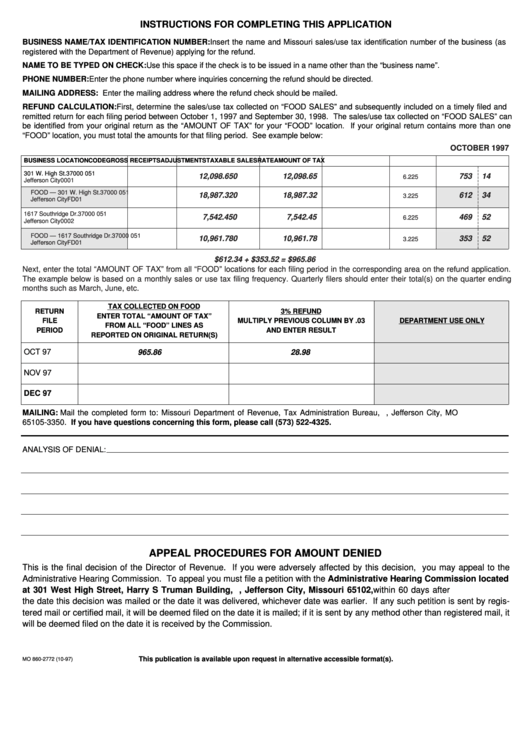

REFUND CALCULATION: First, determine the sales/use tax collected on “FOOD SALES” and subsequently included on a timely filed and

remitted return for each filing period between October 1, 1997 and September 30, 1998. The sales/use tax collected on “FOOD SALES” can

be identified from your original return as the “AMOUNT OF TAX” for your “FOOD” location. If your original return contains more than one

“FOOD” location, you must total the amounts for that filing period. See example below:

OCTOBER 1997

BUSINESS LOCATION

CODE

GROSS RECEIPTS

ADJUSTMENTS

TAXABLE SALES

RATE

AMOUNT OF TAX

301 W. High St.

37000 051

12,098.65

0

12,098.65

753

14

6.225

Jefferson City

0001

FOOD — 301 W. High St.

37000 051

18,987.32

0

18,987.32

612

34

3.225

Jefferson City

FD01

1617 Southridge Dr.

37000 051

7,542.45

0

7,542.45

469

52

6.225

Jefferson City

0002

FOOD — 1617 Southridge Dr.

37000 051

10,961.78

0

10,961.78

353

52

3.225

Jefferson City

FD01

$612.34 + $353.52 = $965.86

Next, enter the total “AMOUNT OF TAX” from all “FOOD” locations for each filing period in the corresponding area on the refund application.

The example below is based on a monthly sales or use tax filing frequency. Quarterly filers should enter their total(s) on the quarter ending

months such as March, June, etc.

TAX COLLECTED ON FOOD

RETURN

3% REFUND

ENTER TOTAL “AMOUNT OF TAX”

FILE

MULTIPLY PREVIOUS COLUMN BY .03

DEPARTMENT USE ONLY

FROM ALL “FOOD” LINES AS

PERIOD

AND ENTER RESULT

REPORTED ON ORIGINAL RETURN(S)

OCT 97

965.86

28.98

NOV 97

DEC 97

MAILING: Mail the completed form to: Missouri Department of Revenue, Tax Administration Bureau, P.O. Box 3350, Jefferson City, MO

65105-3350. If you have questions concerning this form, please call (573) 522-4325.

ANALYSIS OF DENIAL:

APPEAL PROCEDURES FOR AMOUNT DENIED

This is the final decision of the Director of Revenue. If you were adversely affected by this decision, you may appeal to the

Administrative Hearing Commission. To appeal you must file a petition with the Administrative Hearing Commission located

at 301 West High Street, Harry S Truman Building, P.O. Box 1557, Jefferson City, Missouri 65102, within 60 days after

the date this decision was mailed or the date it was delivered, whichever date was earlier. If any such petition is sent by regis-

tered mail or certified mail, it will be deemed filed on the date it is mailed; if it is sent by any method other than registered mail, it

will be deemed filed on the date it is received by the Commission.

This publication is available upon request in alternative accessible format(s).

MO 860-2772 (10-97)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1