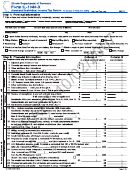

Form Il-1040-X Draft - Amended Individual Income Tax Return Page 2

ADVERTISEMENT

Name

Social Security no.

For tax year

___ ___ ___ – ___ ___ – ___ ___ ___ ___

_____ / _____

Step 2: Continued from Page 1

Column B

Corrected figures

25

25

Write the amount from Page 1, Line 25 .

_____________|____

26

26

If Line 16 is less than Line 25, subtract Line 16 from Line 25. This is your refund.

_____________|____

27

27

If Line 16 is greater than Line 25, subtract Line 25 from Line 16. This is your tax due.

_____________|____

+

=

28

28

Penalty and interest (See instructions.) _____________|____

_____________|____

_____________|____

Penalty amount

Interest amount

29

29

Add Lines 27 and 28. This is your total balance due.

_____________|____

Official Use

Step 3: Reason for filing (Everyone filing this return must complete this step.)

If you are changing your Illinois return due to a change to your federal return, do not file this form until you receive notification that

the IRS has accepted the changes. Refer to ‘‘How long do I have to correct or amend my return?’’ on Page 1 of the Form IL-1040-X

instructions.

30

For the tax year you are amending, on what date did you file your most recent Illinois Form IL-1040,

______/______/______

Form IL-1040-X or electronically filed return?

Month

Day

Year

31

Did you file a U.S. Form 1040X?

yes

no

If you filed a U.S. Form 1040X, you must attach to this form:

a copy of your U.S. Form 1040X, and

a copy of the notification you received from the Internal Revenue Service (IRS) stating that they accepted

the changes shown on your U.S. Form 1040X; e.g., a refund check, "Statement of Account," agreement, or

judgment. You must write the date the IRS notified you (not the date you filed your U.S. 1040X) in the

appropriate space in Step 1, Line 5. Failure to provide this date could result in an assessment of a

late-payment penalty.

32

Are you filing this form because of a federal audit?

yes

no

If ‘‘yes,’’ be sure to write the date of finalization in the appropriate space in Step 1, Line 5, and attach copies

of all federal audit reports. Failure to provide this date could result in an assessment of a late-payment penalty.

33

Have you received notification that your return is under audit by the Illinois Department of Revenue?

yes

no

34

Explain, in detail, the reason(s) for filing this amended return. Attach a separate sheet if necessary.

Step 4: Sign and date

Under penalties of perjury, I state that I have examined this return, and, to the best of my knowledge, it is true, correct, and complete.

Your signature

Date

Daytime phone number

Your spouse’s signature

Date

Sign

here

Paid preparer’s signature

Date

Preparer’s phone number

Preparer’s FEIN, SSN, or PTIN

Mail to: Illinois Department of Revenue, P.O. Box 19007, Springfield, IL 62794‑9007

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-0074

RD

DX

PX QX

XF XY NO

RA

X

J

F

DR

ID

Page 2 of 4

IL-1040-X (R-12/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2