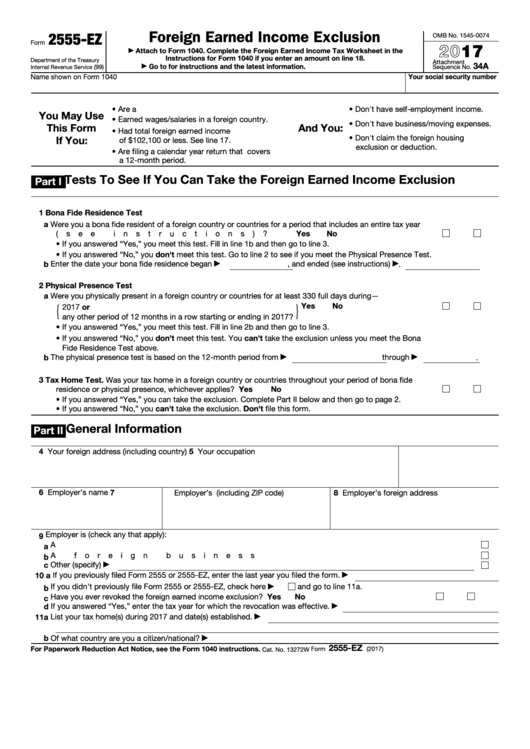

Foreign Earned Income Exclusion

2555-EZ

OMB No. 1545-0074

Form

2017

Attach to Form 1040. Complete the Foreign Earned Income Tax Worksheet in the

▶

Instructions for Form 1040 if you enter an amount on line 18.

Department of the Treasury

Attachment

34A

Go to for instructions and the latest information.

(99)

Sequence No.

Internal Revenue Service

▶

Your social security number

Name shown on Form 1040

• Are a U.S. citizen or a resident alien.

• Don't have self-employment income.

You May Use

• Earned wages/salaries in a foreign country.

• Don't have business/moving expenses.

This Form

And You:

• Had total foreign earned income

• Don't claim the foreign housing

If You:

of $102,100 or less. See line 17.

exclusion or deduction.

• Are filing a calendar year return that covers

a 12-month period.

Tests To See If You Can Take the Foreign Earned Income Exclusion

Part I

1

Bona Fide Residence Test

a Were you a bona fide resident of a foreign country or countries for a period that includes an entire tax year

(see instructions)? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

• If you answered “Yes,” you meet this test. Fill in line 1b and then go to line 3.

• If you answered “No,” you don't meet this test. Go to line 2 to see if you meet the Physical Presence Test.

b Enter the date your bona fide residence began

, and ended (see instructions)

.

▶

▶

2

Physical Presence Test

a Were you physically present in a foreign country or countries for at least 330 full days during—

{

}

Yes

No

2017 or

.

.

.

.

.

.

.

.

.

.

.

.

.

any other period of 12 months in a row starting or ending in 2017?

• If you answered “Yes,” you meet this test. Fill in line 2b and then go to line 3.

• If you answered “No,” you don't meet this test. You can't take the exclusion unless you meet the Bona

Fide Residence Test above.

b The physical presence test is based on the 12-month period from

through

.

▶

▶

3

Tax Home Test. Was your tax home in a foreign country or countries throughout your period of bona fide

Yes

No

residence or physical presence, whichever applies? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

• If you answered “Yes,” you can take the exclusion. Complete Part II below and then go to page 2.

• If you answered “No,” you can't take the exclusion. Don't file this form.

General Information

Part II

4 Your foreign address (including country)

5 Your occupation

6 Employer’s name

7 Employer’s U.S. address (including ZIP code) 8 Employer’s foreign address

Employer is (check any that apply):

9

a A U.S. business .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b A foreign business .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

c Other (specify)

▶

10 a If you previously filed Form 2555 or 2555-EZ, enter the last year you filed the form.

▶

b If you didn't previously file Form 2555 or 2555-EZ, check here

and go to line 11a.

▶

Yes

No

c Have you ever revoked the foreign earned income exclusion?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

d If you answered “Yes,” enter the tax year for which the revocation was effective.

▶

11a List your tax home(s) during 2017 and date(s) established.

▶

b Of what country are you a citizen/national?

▶

2555-EZ

For Paperwork Reduction Act Notice, see the Form 1040 instructions.

Form

(2017)

Cat. No. 13272W

1

1 2

2