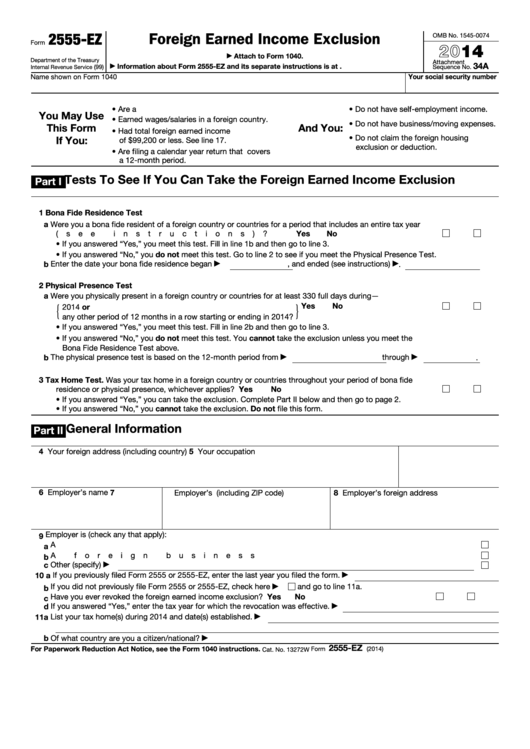

2555-EZ

Foreign Earned Income Exclusion

OMB No. 1545-0074

Form

2014

Attach to Form 1040.

▶

Department of the Treasury

Attachment

34A

Information about Form 2555-EZ and its separate instructions is at

(99)

Sequence No.

Internal Revenue Service

▶

Your social security number

Name shown on Form 1040

• Are a U.S. citizen or a resident alien.

• Do not have self-employment income.

You May Use

• Earned wages/salaries in a foreign country.

• Do not have business/moving expenses.

This Form

And You:

• Had total foreign earned income

• Do not claim the foreign housing

If You:

of $99,200 or less. See line 17.

exclusion or deduction.

• Are filing a calendar year return that covers

a 12-month period.

Tests To See If You Can Take the Foreign Earned Income Exclusion

Part I

1

Bona Fide Residence Test

a Were you a bona fide resident of a foreign country or countries for a period that includes an entire tax year

(see instructions)? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

• If you answered “Yes,” you meet this test. Fill in line 1b and then go to line 3.

• If you answered “No,” you do not meet this test. Go to line 2 to see if you meet the Physical Presence Test.

b Enter the date your bona fide residence began

, and ended (see instructions)

.

▶

▶

2

Physical Presence Test

a Were you physically present in a foreign country or countries for at least 330 full days during—

{

}

Yes

No

2014 or

.

.

.

.

.

.

.

.

.

.

.

.

.

any other period of 12 months in a row starting or ending in 2014?

• If you answered “Yes,” you meet this test. Fill in line 2b and then go to line 3.

• If you answered “No,” you do not meet this test. You cannot take the exclusion unless you meet the

Bona Fide Residence Test above.

b The physical presence test is based on the 12-month period from

through

.

▶

▶

3

Tax Home Test. Was your tax home in a foreign country or countries throughout your period of bona fide

Yes

No

residence or physical presence, whichever applies? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

• If you answered “Yes,” you can take the exclusion. Complete Part II below and then go to page 2.

• If you answered “No,” you cannot take the exclusion. Do not file this form.

General Information

Part II

4 Your foreign address (including country)

5 Your occupation

6 Employer’s name

7 Employer’s U.S. address (including ZIP code) 8 Employer’s foreign address

Employer is (check any that apply):

9

a A U.S. business .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b A foreign business .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

c Other (specify)

▶

10 a If you previously filed Form 2555 or 2555-EZ, enter the last year you filed the form.

▶

b If you did not previously file Form 2555 or 2555-EZ, check here

and go to line 11a.

▶

Yes

No

c Have you ever revoked the foreign earned income exclusion?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

d If you answered “Yes,” enter the tax year for which the revocation was effective.

▶

11a List your tax home(s) during 2014 and date(s) established.

▶

b Of what country are you a citizen/national?

▶

2555-EZ

For Paperwork Reduction Act Notice, see the Form 1040 instructions.

Form

(2014)

Cat. No. 13272W

1

1 2

2