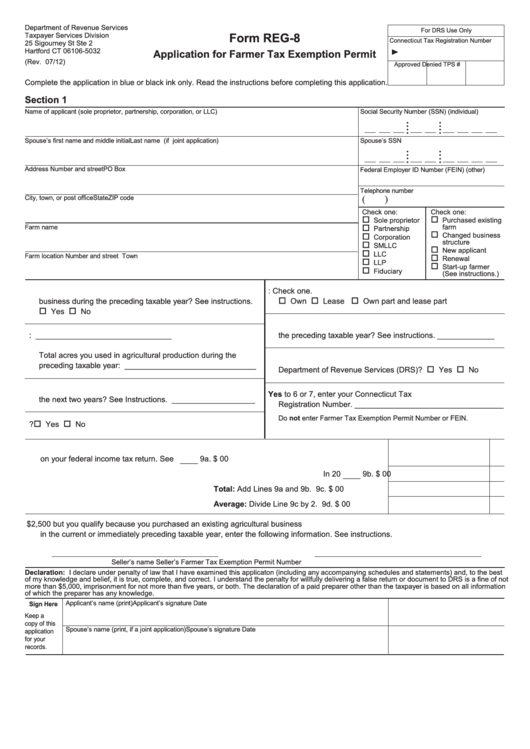

Department of Revenue Services

For DRS Use Only

Form REG-8

Taxpayer Services Division

Connecticut Tax Registration Number

25 Sigourney St Ste 2

Hartford CT 06106-5032

Application for Farmer Tax Exemption Permit

(Rev. 07/12)

Approved

Denied

TPS #

Complete the application in blue or black ink only. Read the instructions before completing this application.

Section 1

Name of applicant (sole proprietor, partnership, corporation, or LLC)

Social Security Number (SSN) (individual)

•

•

•

•

•

•

•

•

Spouse’s first name and middle initial

Last name

(if joint application)

Spouse’s SSN

•

•

•

•

•

•

•

•

Address

Number and street

PO Box

Federal Employer ID Number (FEIN) (other)

Telephone number

(

)

City, town, or post office

State

ZIP code

Check one:

Check one:

Sole proprietor

Purchased existing

farm

Farm name

Partnership

Changed business

Corporation

structure

SMLLC

New applicant

LLC

Farm location

Number and street

Town

Renewal

LLP

Start-up farmer

Fiduciary

(See instructions.)

1. Were you engaged in agricultural production as a trade or

2. Farmland ownership: Check one.

business during the preceding taxable year? See instructions.

Own

Lease

Own part and lease part

Yes

No

4. What farm products including livestock did you produce during

the preceding taxable year? See instructions. _____________

3. Total acreage of farm: _______________________________

Total acres you used in agricultural production during the

6. Have you been issued a Sales and Use Tax Permit by the

preceding taxable year: ______________________________

Department of Revenue Services (DRS)?

Yes

No

5. What farm products including livestock will you produce during

8. If you answered Yes to 6 or 7, enter your Connecticut Tax

the next two years? See Instructions. ___________________

Registration Number. __________________________________

Do not enter Farmer Tax Exemption Permit Number or FEIN.

7. Do you have employees?

Yes

No

9. State the gross income you derived solely from agricultural production as reported

on your federal income tax return. See instructions.

In 20 ____

9a. $

00

In 20 ____

9b. $

00

Total: Add Lines 9a and 9b.

9c. $

00

Average: Divide Line 9c by 2.

9d. $

00

10. If the amount entered on Line 9b or Line 9d is less than $2,500 but you qualify because you purchased an existing agricultural business

in the current or immediately preceding taxable year, enter the following information. See instructions.

Seller’s name

Seller’s Farmer Tax Exemption Permit Number

Declaration: I declare under penalty of law that I have examined this applicaton (including any accompanying schedules and statements) and, to the best

of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fine of not

more than $5,000, imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information

of which the preparer has any knowledge.

Applicant’s name (print)

Applicant’s signature

Date

Sign Here

Keep a

copy of this

Spouse’s name (print, if a joint application)

Spouse’s signature

Date

application

for your

records.

1

1 2

2 3

3 4

4