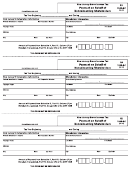

Form Nj 1040-Sc - Payment On Behalf Of Nonconsenting Shareholders - 2014 Page 2

ADVERTISEMENT

INSTRUCTIONS FOR NJ-1040-SC

2014 - S - Page 25

For the S Corporation:

1.

A separate form must be completed for each nonconsenting shareholder and submitted with the CBT-100S. Attach the completed

form(s) to the front of page 1 of the CBT-100S that is filed by the corporation.

2.

Payment Due Date;

Payment should be remitted no later than the time for the filing of the CBT-100S for the accounting or privilege period of the S

corporation.

3.

The payment amount on the NJ-1040-SC should match the amount on the individual shareholder’s NJ-K-1, Part II, line 4.

4.

The remittance for the total of all NJ-1040-SC forms is to be included with any corporation business tax due as shown on page 1 of the

CBT-100S form.

5.

A copy of the completed form must be supplied to each shareholder on whose behalf it was filed on or before the due date of the CBT-

100S.

For the Shareholder:

1.

Payments made by the S corporation on behalf of the shareholder does not release the shareholder of his responsibility for making

estimated payments or filing a New Jersey Gross Income Tax Return as required under the New Jersey Gross Income Tax Statutes.

2.

A copy of the NJ-1040-SC form must accompany the New Jersey Gross Income Tax return you file. The payment is to be claimed on

the return along with any other estimated payments you have made.

3.

Be sure to keep a copy of the form for your records.

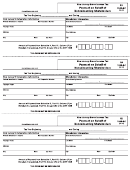

INSTRUCTIONS FOR NJ-1040-SC

For the S Corporation:

1.

A separate form must be completed for each nonconsenting shareholder and submitted with the CBT-100S. Attach the completed

form(s) to the front of page 1 of the CBT-100S that is filed by the corporation.

2.

Payment Due Date;

Payment should be remitted no later than the time for the filing of the CBT-100S for the accounting or privilege period of the S

corporation.

3.

The payment amount on the NJ-1040-SC should match the amount on the individual shareholder’s NJ-K-1, Part II, line 4.

4.

The remittance for the total of all NJ-1040-SC forms is to be included with any corporation business tax due as shown on page 1 of the

CBT-100S form.

5.

A copy of the completed form must be supplied to each shareholder on whose behalf it was filed on or before the due date of the CBT-

100S.

For the Shareholder:

1.

Payments made by the S corporation on behalf of the shareholder does not release the shareholder of his responsibility for making

estimated payments or filing a New Jersey Gross Income Tax Return as required under the New Jersey Gross Income Tax Statutes.

2.

A copy of the NJ-1040-SC form must accompany the New Jersey Gross Income Tax return you file. The payment is to be claimed on

the return along with any other estimated payments you have made.

3.

Be sure to keep a copy of the form for your records.

INSTRUCTIONS FOR NJ-1040-SC

For the S Corporation:

1.

A separate form must be completed for each nonconsenting shareholder and submitted with the CBT-100S. Attach the completed

form(s) to the front of page 1 of the CBT-100S that is filed by the corporation.

2.

Payment Due Date;

Payment should be remitted no later than the time for the filing of the CBT-100S for the accounting or privilege period of the S

corporation.

3.

The payment amount on the NJ-1040-SC should match the amount on the individual shareholder’s NJ-K-1, Part II, line 4.

4.

The remittance for the total of all NJ-1040-SC forms is to be included with any corporation business tax due as shown on page 1 of the

CBT-100S form.

5.

A copy of the completed form must be supplied to each shareholder on whose behalf it was filed on or before the due date of the CBT-

100S.

For the Shareholder:

1.

Payments made by the S corporation on behalf of the shareholder does not release the shareholder of his responsibility for making

estimated payments or filing a New Jersey Gross Income Tax Return as required under the New Jersey Gross Income Tax Statutes.

2.

A copy of the NJ-1040-SC form must accompany the New Jersey Gross Income Tax return you file. The payment is to be claimed on

the return along with any other estimated payments you have made.

3.

Be sure to keep a copy of the form for your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2