Schedule K-1 (Form Fid-3) - Beneficiary'S Share Of Income (Loss), Deductions, Credits, Etc.

ADVERTISEMENT

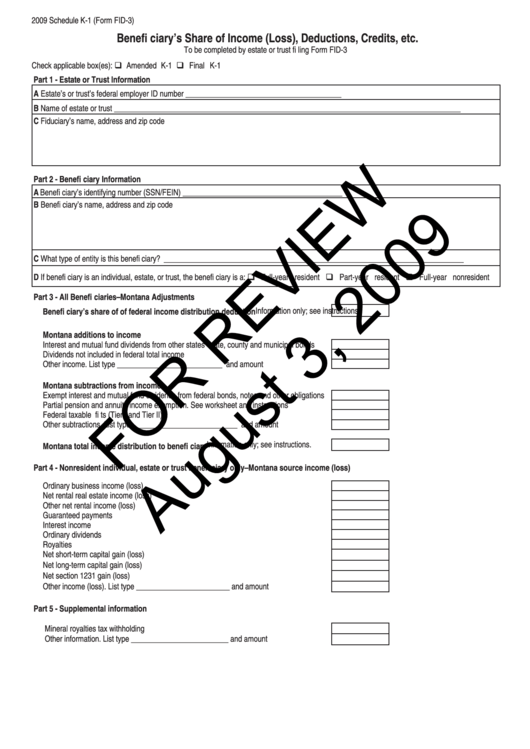

2009 Schedule K-1 (Form FID-3)

Benefi ciary’s Share of Income (Loss), Deductions, Credits, etc.

To be completed by estate or trust fi ling Form FID-3

Check applicable box(es): Amended K-1

Final K-1

Part 1 - Estate or Trust Information

A Estate’s or trust’s federal employer ID number ________________________________________

B Name of estate or trust _________________________________________________________________________________________

C Fiduciary’s name, address and zip code

Part 2 - Benefi ciary Information

A Benefi ciary’s identifying number (SSN/FEIN) _________________________________________

B Benefi ciary’s name, address and zip code

C What type of entity is this benefi ciary? _____________________________________________________________________________

D If benefi ciary is an individual, estate, or trust, the benefi ciary is a: Full-year resident

Part-year resident

Full-year nonresident

Part 3 - All Benefi ciaries–Montana Adjustments

Information only; see instructions.

Benefi ciary’s share of of federal income distribution deduction

Montana additions to income

Interest and mutual fund dividends from other states’ state, county and municipal bonds

Dividends not included in federal total income

Other income. List type ___________________________ and amount

Montana subtractions from income

Exempt interest and mutual fund dividends from federal bonds, notes and other obligations

Partial pension and annuity income exemption. See worksheet and instructions

Federal taxable U.S. Railroad Retirement Board benefi ts (Tier I and Tier II)

Other subtractions. List type ___________________________ and amount

Information only; see instructions.

Montana total income distribution to benefi ciary

Part 4 - Nonresident individual, estate or trust benefi ciary only–Montana source income (loss)

Ordinary business income (loss)

Net rental real estate income (loss)

Other net rental income (loss)

Guaranteed payments

Interest income

Ordinary dividends

Royalties

Net short-term capital gain (loss)

Net long-term capital gain (loss)

Net section 1231 gain (loss)

Other income (loss). List type ________________________ and amount

Part 5 - Supplemental information

Mineral royalties tax withholding

Other information. List type _________________________ and amount

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1